What if the next big investment opportunity isn’t buried in mines… but in the scrap yards?

Welcome to the metal recycling revolution—a sector that’s turning yesterday’s waste into today’s wealth.

For intelligent investors, this is more than a clean play – it’s a smart play. The question is: Are you looking at the stocks where the real value is being recycled?

This article will walk you through the metal recycling companies that have promising futures and good fundamentals.

Here are 5 metal recycling stocks to watch out for in 2025.

These stocks are filtered using Equitymaster’s powerful stock screener – Best Metal Recycling Stocks in India.

Have a look…

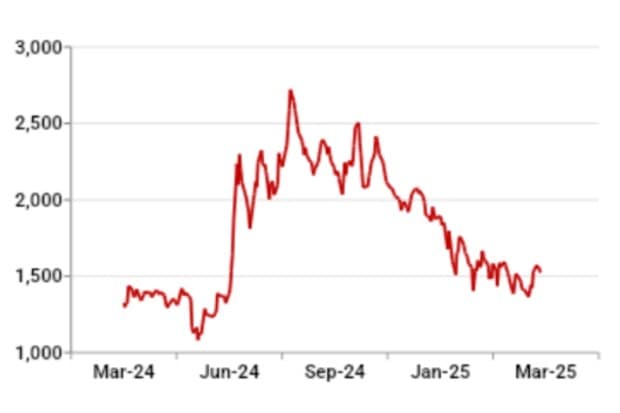

#1 Gravita India

First on the list is Gravita India Ltd.

Established in 1992, Gravita India is one of the largest lead producers in India and aims to be one of the most valuable companies in the recycling space globally.

The company’s is organised across different verticals: lead recycling (flagship), aluminium recycling, plastic recycling, rubber recycling, and turnkey projects.

The company also has expertise in the recycling used batteries, cable scrap/other lead scrap, aluminium scrap, plastic scrap, etc.

The value-added products include customised lead alloys, lead sheets, lead bricks, red lead, and lead oxide for industrial and battery applications.

These higher margin products contribute 46% to revenue, and the target is to reach 50% by FY27.

The company has multiple facilities across the world. The Indian facilities are in Jaipur, Jaipur SEZ, Chittoor, Mundra, Kathua. The overseas facilities are in Ghana, Senegal, Mozambique, Tanzania, Togo, Sri Lanka, Oman, Dominican Republic, and Romania.

The capacity of the company is 334,000 MTPA (million tonnes per annum) as of FY25. The company is targeting a capacity of 700,000+ MTPA by FY28.

The upcoming diversification of the company is a pilot project of lithium-ion battery recycling that is currently underway. Its commercial operations are targeted for H1 FY26.

The company has given FY26 volume/revenue growth guidance of 20-30% with more than 35% profitability growth over the next three years.

Coming to the financials, the company’s revenue has grown at a CAGR of 20.6% in the last five years, while its net profit has grown at a CAGR of 65.7%. The five-year average return on equity (RoE) is 27.9%, and return on capital employed (RoCE) is 34.4%.

#2 Pondy Oxides & Chemicals Ltd (POCL)

Next on the list is Pondy Oxides & Chemicals Ltd.

Incorporated in 1995, POCL manufactures lead metal and alloys and other non-ferrous metals.

In the metallic and non-metallic recycling industry in India, POCL is the largest secondary lead and alloy manufacturer. Its core product, lead and lead alloys, is mainly used in making lead-acid batteries.

The company converts scraps of various forms of lead, aluminium, and copper into lead metal, aluminium metal, copper, and its alloys. It also manufactures zinc metal and zinc oxide.

The company is present in 20+ countries across Asia, Europe, the Middle East, and North America.

The clientele include Amara Raja Batteries, Sebang Global Battery Company, Tata Batteries, Motherson, and Glencore International AG etc.

The POCL brand is also listed on the London Metal Exchange.

The company is expanding its lead capacity by 72,000 MTPA to reach 204,000 MT p.a. after the expansion.

Coming to the financials, the company’s revenue has grown at a CAGR of 8% in the last five years, while its net profit has fallen at a CAGR of -1.1%.

The five-year average return on equity (RoE) is 15.7%, and return on capital employed (RoCE) is 23.9%.

#3 Eco Recycling

Next on the list is Eco Recycling Ltd.

Eco Recycling Ltd (Ecoreco) is India’s 1st and leading E-waste management company.

The company combines automation and manual processing to sort, dismantle, shred, segregate, and recover from e-waste.

It offers end-to-end solutions of reverse logistics, data destruction, information technology asset disposition (ITAD), recycling of E-waste, lamp recycling, precious metal recovery, recycling on wheels-SmartER. The company has a recycling capacity of 31,200 MTPA.

The upcoming 6,000 MTPA capacity in 2025 is dedicated to Li-ion battery recycling through a partnership with C-MET.

The company has a PAN-India logistics network and a global footprint spanning over 120 countries through exports, logistics, and strategic partnerships.

The Rs 15 billion (bn) PLI scheme was proposed to boost formal recycling and critical mineral recovery. This is a government push for E-waste recycling which should help the company’s growth.

Coming to the financials, the company’s revenue has grown at a CAGR of 17.6% in the last five years, while its net profit has grown at a CAGR of 75.3%.

The five-year average return on equity (RoE) is 17.1%, and return on capital employed (RoCE) is 18.4%.

#4 Nupur Recyclers

Next on the list is Nupur Recyclers Ltd.

Incorporated in 2019, Nupur Recyclers is in the business of importing and processing/trading of ferrous and nonferrous metals.

It processes materials from recyclables such as metal or scrap and develops recycled products. The company recycles non-ferrous metal scrap to make quality products for its customers.

Its product profile includes aluminium Zorba, shredded brass, shredded zinc, zinc diecast, Zurich, and zinc.

On 16 March 2024, the company acquired 4.4 m equity shares, representing 80% of M/s Frank Metals Recyclers Private Limited (FMRPL). FMRPL is engaged in the business of trading & recycling of ferrous and non-ferrous metal scrap.

Coming to the financials, the company’s revenue has grown at a CAGR of 205.2% in the last five years, while its net profit has grown at a CAGR of 277.8%.

The five-year average return on equity (RoE) is 44%, and return on capital employed (RoCE) is 172.3%.

#5 Nile

Last on the list is Nile Ltd.

Incorporated in 1984, Nile Ltd is a manufacturer of pure lead for battery consumption. The company is an ISO 9001:2015 certified secondary manufacturer of pure lead and lead alloys.

Its products are supplied to the manufacturers of lead-acid batteries, PVC stabilizers, and lead oxide.

Apart from this, the company also deals in power generation through wind farms.

The company has two lead recycling plants, one in Choutuppal with a capacity of 32,000 TPA, and the other in Tirupati with a capacity of 75,000 TPA.

The company has the top two customers, Amara Raja Batteries Limited (ARBL), which accounts for 91% of the sales, and Mangal Industries Limited (part of the ARBL group) accounts for 9% of the sales.

The major customer, ARBL, is in the process of setting up its own lead smelter, which will affect the total volume offtake.

Coming to the financials, the company’s revenue has grown at a CAGR of 8% in the last five years, while its net profit has grown at a CAGR of 20%.

The five-year average return on equity (RoE) is 11%, and return on capital employed (RoCE) is 15.9%.

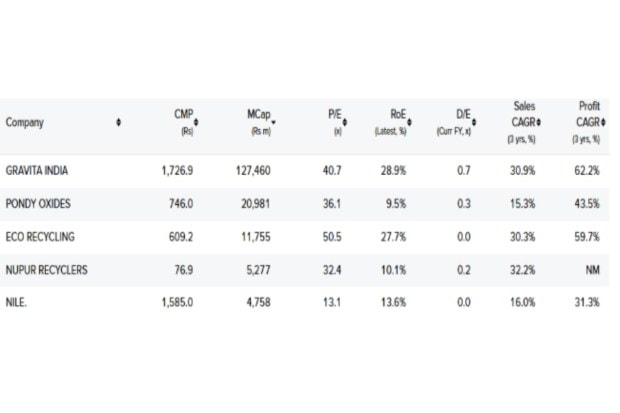

Snapshot of Best Metal Recycling Stocks in India on Equitymaster’s Stock Screener

Here’s a table that shows the Best Metal recycling Stocks in India across various parameters.

Conclusion

The companies in metal recycling are technology-driven, scalable, and globally competitive with good historical growth.

Government initiatives like the Extended Producer Responsibility (EPR), Battery Waste Management Rules, Non-Ferrous Metal Recycling Framework, and the focus on a circular economy are creating favourable long-term trends.

Keeping an eye on these companies could offer a long-term investing opportunity.

Investors should evaluate the company’s fundamentals, corporate governance, and valuations of the stock as key factors when conducting due diligence before making an investment decision.

Happy Investing.

Disclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such. Learn more about our recommendation services here…

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.