Over the last few months, the Indian stock markets have recovered steadily.

This recovery came after the global uncertainties regarding Trump’s tariffs subsided.

But during this whole roller-coaster ride, many stocks have become multibaggers.

Retail investors generally shy away from buying stocks that have already run up sharply. They look for stocks that are down in dumps, hoping for a revival that may never come.

But the old winners keep on performing. That’s why it’s a wise idea to keep tracking and evaluating old multibaggers.

Keeping that in mind, here are the 5 multibagger stocks to keep on your radar in 2025.

As they might still have some juice left in them.

Take a look…

#1 Garware Hi Tech Films

First on the list is Garware Hi Tech Films.

Established in 1957, it’s engaged in the manufacturing of polyester films used in a variety of end-applications such as window tint, automobile paint protection films, packaging, electrical and motor cable insulations, shrink film, and architectural film.

Initially it operated as a high-volume, low-margin commoditised polyester film company. The company has undergone a significant strategic transformation to become a leading consumer product company.

It has a major share in value-added margin accretive products, such as SCF, shrink films, PPF, and low-oligomer products. This strategic shift has resulted in revenue recovery and enhanced margins.

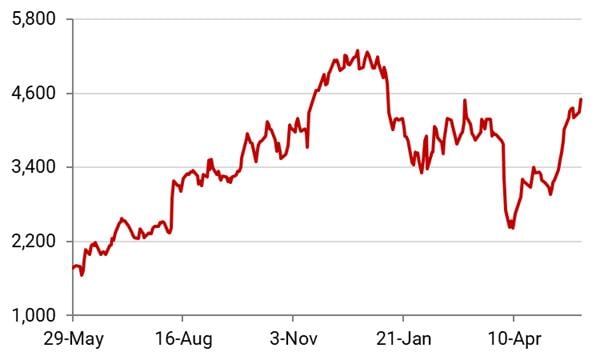

The stock has become a multibagger. It’s up 184% in last 1 year.

Coming to its financial performance, the company has delivered a top-line growth of 17% compounded annual growth rate (CAGR) over a 3-year period and a net profit CAGR of 29%. The last 3-year return on equity (ROE) has been 12%.

Garware Hi Tech Films Stock Price – 1 Year

Data Source: Ace Equity

Looking ahead, the company is confident in achieving a revenue of Rs 25 bn for FY26 and expects a top line growth of 20-25% CAGR for FY27 and beyond.

Profitability is expected to remain healthy, with operating margins guided to be in the range of 22-25%.

The newly announced TPU extrusion line, expected to commence production by October 2026, is anticipated to contribute a 1.5-2% improvement in operating margins.

The company expects to see consistent growth in the bottom line with operating margins increasing slowly.

#2 Shaily Engineering Plastics

Second on the list is Shaily Engineering Plastics.

It’s a Gujarat-based company, established in 1980, engaged in the manufacturing of high precision injection moulded plastic components and sub-assemblies for various requirements of original equipment manufacturers (OEM).

It offers secondary operations for plastics including vacuum metalising, hot stamping, and ultrasonic welding.

The company serves a wide range of industries, with its business broadly divided into three segments: consumer, healthcare (pharmaceuticals), and industrial.

It derives strength from its established presence in the plastic injection moulding business, the extensive experience of its promoters in the plastic packaging industry, and long-standing relationships with reputable global and domestic clientele across diverse end-user sectors.

Operating within the niche area of precision moulding, it serves the specific requirements of leading global companies.

The company is recognized as India’s largest exporter of plastics components and is a two-star export house, utilizing over 200 injection moulding machines with precise, high-speed automated, and robotic production lines, supported by an in-house research & development unit.

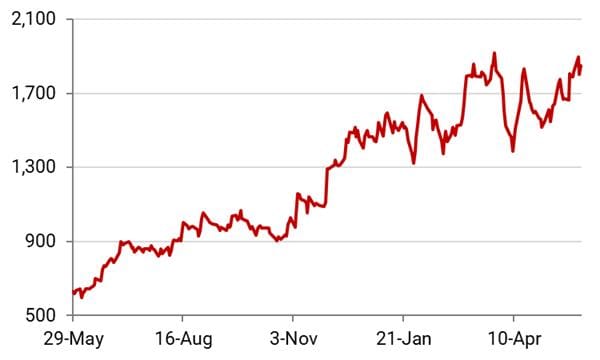

The stock is up 197% in one year.

Shaily Engineering Plastics Stock Price – 1 Year

Data Source: Ace Equity

Coming to its financial performance, the company has delivered a top-line growth of 11% CAGR over a 3-year period and a net profit CAGR of 38%. The last 3-year ROE has been 14%.

Looking ahead, the company management expresses immense confidence in the ability to scale up further and grow based on the current visibility across various businesses.

Growth is expected across all three segments (consumer, healthcare, industrial) in FY26, although the rate of growth will differ among segments.

New contracts in the consumer and healthcare segments provide good revenue visibility. The company is in discussions with customers about volume or capacity commitments for the next 3 to 5 years.

The pen manufacturing capacity is being expanded by another 40-50 million (m) pens per year, primarily targeting the growing GLP-1 demand.

This expansion is planned over the next 18-24 months, with Rs 1.5 bn capex allocated for FY26. The total capacity is expected to reach 80-90 m pens after this expansion.

#3 V2 Retail

At number three comes V2 Retail, a retailer primarily focused on offering apparels and general merchandise to the neo middle class and middle class segments of society.

V2 Retail emphasizes “Value & Variety” in its product portfolio across its stores. As of the end of FY25, the company operated 189 stores across 20 states and about 150 cities, mostly in tier-II and tier-III locations, covering a retail area more than 2 m sq. ft.

Apparel is the company’s strength and focus, contributing over 90% of sales.

Coming to its financial performance, the company has delivered a top-line growth of 44% CAGR over a 3-year period and a net profit CAGR of 101%.

The last 3-year ROE has been 12%.

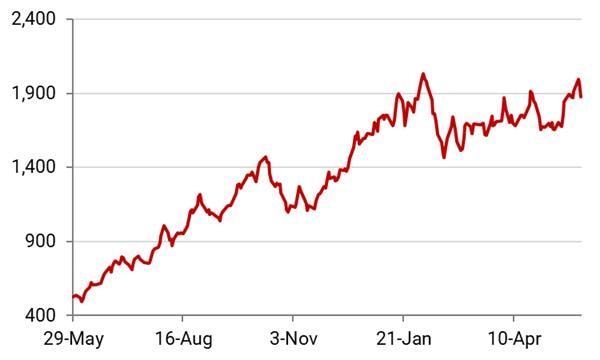

So, it would come as no surprise that the stock is up 250% in the last 1 year.

V2 Retail Stock Price – 1 Year

Data Source: Ace Equity

Looking ahead to FY26 and FY27, it has guided for a revenue growth of 45-50% YoY.

This significant growth is expected to come from a combination of growth in existing stores and expansion through new store additions. The company believes the total addressable market is huge and their current growth level is achievable.

In terms of profitability, the company expects to profitable in all four quarters in the coming years, even with seasonality. It targets EBITDA margin of 8-9%. This is expected to translate to a net margin of 4-5%.

Opening many new stores (which initially have lower sales per sq. ft.) might temper a huge expansion in EBITDA margin. But it expects some operating leverage benefits from spreading head office and warehousing costs over a larger retail area.

The company is targeting a ROE of 25% in the next 18 to 24 months.

The company is on track to open 100 stores in FY26. It plans to open at least 100 stores every year for the next four to five years and potentially reach 600 to 700 stores or more in this timeframe.

This expansion is planned to be funded primarily through internal accruals for the targeted 100 stores, although it might consider equity infusion to accelerate growth beyond this rate.

About 60-70% of new stores will be in existing clusters, while 20-30% will be in newer markets. The company will use the initial 1-2 stores to test and learn before expanding further in that cluster.

#4 Kitex Garments

Fourth on the list is Kitex Garments.

Established in 1992, it’s primarily involved in the manufacturing and export of knitted garments for infants and children aged 0-24 months. It operates as a fully export-oriented unit.

The company is the world’s second-largest manufacturer of cotton and organic cotton ready-to-wear garments for infants and children.

Utilizing a “Yarn to Garments” operating model, it serves major clients in the US and European markets.

The company maintains its market leadership in its primary market, the US, and plans to expand into European and Australian markets, as well as diversify its product offerings by entering the adult wear segment through its new facility in Telangana.

Coming to its financial performance, the company has delivered a top-line growth of 11% CAGR over a 3-year period and a net profit CAGR of 1%.

The last 3-year ROE has been 10%.

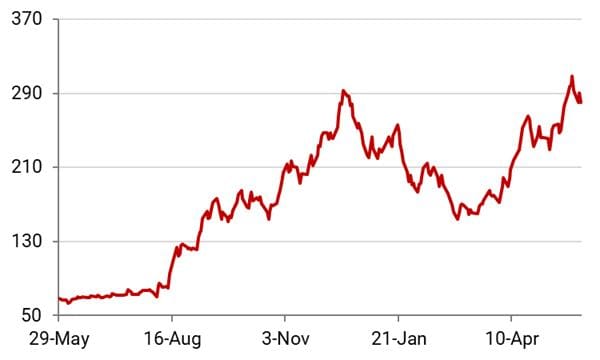

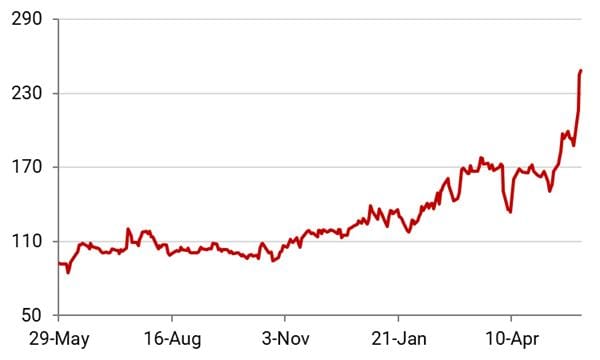

The stock has delivered over 300% in returns.

Kitex Garments Stock Price – 1 Year

Data Source: Ace Equity

Looking ahead, Kitex Garments’ management has expressed optimism and anticipates strong growth. A major part of the company’s prospects is around its expansion project in Telangana through its subsidiary, Kitex Apparel Parks (KAPL).

The total planned cost for this expansion is about Rs 30 bn, funded through a 70:30 debt-to-equity ratio.

The project includes two locations: Kakatiya Mega Textiles Park in Warangal and Sitarampur Industrial Park near Hyderabad.

Commercial production for phase 1 at Warangal is expected to begin by December 2024, while the second phase is expected to be commercialised by March 2027.

The total investment aims to produce around 1.1 m garments daily, and at full production, the new facilities are expected to generate revenue of Rs 50 bn.

This expansion also involves diversifying product offerings by entering the adult wear segment, including polyester segments, brushed fleece fabrics, and specialised designs for the entire family.

#5 Camlin Fine Sciences

Fifth on the list is Camlin Fine Sciences, a company involved in the research, development, manufacturing, and marketing of specialty chemicals, ingredients, and additive blends.

Its comprehensive product portfolio is broadly categorized into shelf-life solutions, aroma ingredients, performance chemicals, and health & wellness.

These products cater to a diverse range of global industries, including human food, animal feed, pet food, agrochemicals, petrochemicals, pharmaceuticals, nutraceuticals, flavours and fragrances, and healthcare.

Within its shelf-life solutions segment, the company is a global leader in antioxidants and provides customised shelf-life solutions, offering over 200 custom formulations encompassing both traditional and natural solutions.

Coming to its financial performance, the company has delivered a top-line growth of 6% CAGR over a 3-year period and a net profit CAGR of -10%.

The last 3-year ROE has been 1%. Yet the stock is up 162% in the past year.

Camlin Fine Sciences Stock Price – 1 Year

Data Source: Ace Equity

Looking ahead, the blends business is a high-focus area. The management anticipates continued healthy growth in this segment, particularly in North America and the domestic market.

The expected growth rate for the blends business is around 20% going forward in the next 2-3 years.

This will be driven by new customer acquisitions and growth within existing customers across all regions, including North America, Central America, South America, India, Europe, the Middle East, and Africa.

This includes contributions from the newly acquired Vitafor business, which is expected to have higher growth of at least 20-25% in FY26 and thereafter.

The potential acquisition of Vinpai, expected to be completed by the end of July, could further elevate the overall blends growth to 25%, leveraging Vinpai’s growth potential in substantial product categories with differentiated technology.

The blends business has high-teen EBITDA margins, moving towards 20% as the business matures.

In the aroma Ingredients segment, particularly Vanillin, revenue is expected to ramp up further in the coming quarters, especially benefiting from anti-dumping duty actions in the US and Europe.

The company is ramping up production at its Dahej vanillin plant aiming to reach 100% utilisation by FY27.

The business is stabilising and showing improving trends. The gross margin in the second half of FY25 crossed 50%. The target gross margin region is 45-55%.

Conclusion

These stocks have already delivered multibagger returns. Yet, their stories appear far from over.

While their impressive runs might prompt some to hesitate, remember that winners tend to keep winning.

Their focused strategies, clear revenue visibility, and expansion blueprints suggest they could still have significant momentum heading into 2025 and beyond.

However, past success is no guarantee of future returns. These stocks demand close monitoring and rigorous due diligence.

It’s important to conduct thorough research on financials and corporate governance before making investment decisions, ensuring they align with your financial goals and risk tolerance.

Happy Investing.

Disclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such. Learn more about our recommendation services here…

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary