SH Kelkar’s notable presence in the unorganised segment, once considered a strength, appeared to have taken a toll on its financial performance. Smaller players—which account for 15% of its customer base—were severely hit following GST implementation. Revenue from its top 100 customers grew at 10%+, while that from the remaining customers declined by 7-8%, impacting overall showing (up by 0.5% to Rs 10.4 bn in FY19). Importantly, 50% of the company’s smaller customers are likely to be weeded out of the market.

However, according to the company, the structural shift away from the unorganised segment will also serve as an advantage for SHKL because of the addition of mid-and large-size customers.

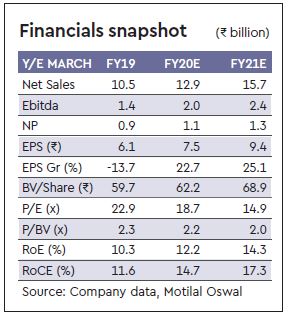

Valuation view: SHKL’s performance has been disappointing for three years now, with its revenue remaining flat at Rs 10 bn and PAT declining from Rs 1,025 m to Rs 885 m. The company’s prospects now hinge on its ability to pursue new segments, grow the existing product categories, and the level of aggression from the FMCG industry to launch new products. However, we are confident about the margin expansion on account of Mahad plant utilisation at optimum levels. We reinstate our rating to Buy (from Under Review) and cut our revenue/PAT estimates by 13/16% on like to like basis for FY20e and FY21e, respectively. We reduce our PE multiple from 22x to 18x to value the stock at FY21e EPS of Rs 9.4/share and arrive at a TP of Rs 169/share.