For Q4FY20, SBI reported net profit of Rs 35.8 bn, which was 57% below our estimate. Income reversal (due to agri NPAs) and high provisions (led by increase in write-offs with increase in provision cover) led to the miss, even as NPA additions moderated to Rs 83 bn (vs the quarterly run-rate of Rs 154 bn for 9MFY20). Loans under moratorium formed 20-23% of loans across the bank’s term loans and working capital loans (ex-agri), led mainly by the SME book.

Net NPA at 2.2%: In Q4FY20, NPA additions were led mainly by agri slippages ( Rs 52 bn). With write-offs ( Rs 163 bn vs quarterly run-rate of Rs 120 bn in 9MFY20) and the increase in NPA provision cover (65%, up from 50% at end-FY18), net NPA declined to 2.2% (consistent reduction from peak 5.7% at end-FY18). Credit costs, however, still stayed elevated at 2.1% (vs 1.9% in 9MFY20, all annualised).

The focus, however, is now also on new stress arising from COVID-19 disruption. The bank reported c.23% of its term loans (by count) and c.20% of its working capital loans were under moratorium at end-May 2020. While this is similar to other large banks, we do expect NPA additions to increase over FY21-22e (average of 3.0% vs 2.6% in FY20). However, SBI’s healthy provision cover on existing NPA means credit costs would likely average at 150bps.

Operating profit hurt by income reversal: For Q4FY20, loan growth slowed to 6% y-o-y and domestic NIM came in at 2.95% (vs 3.27% in 9MFY20), impacted by the large reversal of interest income on agri NPAs (NII down 1% y-o-y). Core fee declined by 8% y-o-y. Staff costs kept opex sticky (2.1% of assets).

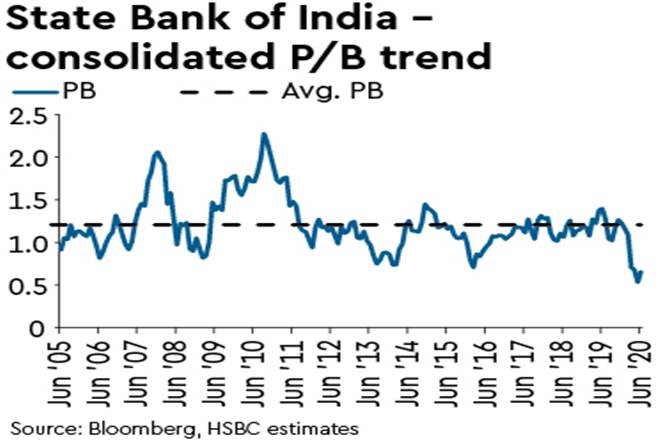

Undemanding valuation; retain Buy on franchise strength: The stock is trading at 0.2x FY21 standalone BV (0.7x consol. BV), in line with other PSU banks. While the asset quality outlook for Indian banks is uncertain with a drawn-out moratorium, we expect SBI to stand out given its stronger balance sheet (domestic CD ratio of 66%, NPA PCR of 65% and Tier 1 of 11%). We expect FY21/22e average RoA/RoE of 0.7/12%. NII drives -5%/2% changes in FY21/22e PAT estimates. Our unchanged TP of Rs 285 implies 1.0x FY21e consolidated BV.