Aphs reported results in line with expectation. Growth in existing hospitals improved led largely by base but was weaker than expected. Losses in Navi Mumbai and Apollo Health and Lifestyle (AHLL) remain elevated. AHLL break-even has been delayed to mid-FY20. We expect growth challenges for APHS to continue and increased competition and regulatory challenges to keep margins and RoCE improvement limited. Retain Hold.

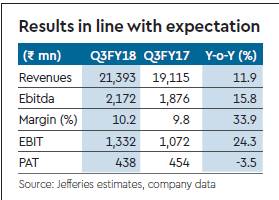

Results in line: Revenue growth at 12% was slightly below (JEFe 15%). Margins in line. AMHI and Gleneagles both returned to profitability after losses in 1H. Existing hospital growth improves: Growth in existing healthcare services improved to 8% though still below peers. New hospitals saw strong 33% growth. Margins in existing hospitals were flat y-o-y & improved 350bps in new hospitals. Pharmacy growth though moderated to 12%.

Q3 margins impacted due to seasonality: Occupancy moderated to 65% vs 68% in Q2. Stent price impact remained at `100 mn. Management expects stent impact to recoup only by end-FY19.

Challenges continue: While APHS has expanded to cover Tier-II cities, its target market is still the affluent class, which is a mature segment. We expect APHS to restart capex from FY19 led by competition and expect hospital Ebitda CAGR of 11%.

Valuation/risks

We marginally tweak our estimates. APHS is trading at 16.5x FY20 EV/Ebitda, a slight premium to its historical valuations though at discount to peers. The discount is justified given the muted growth in key hospital segment. Given the challenges in key cluster and muted growth we retain Hold rating with SOTP TP of Rs 1,140 implying FY20 EV/Ebitda of 15.8x. Risk: Ramp-up in key hospitals and regulatory price caps.