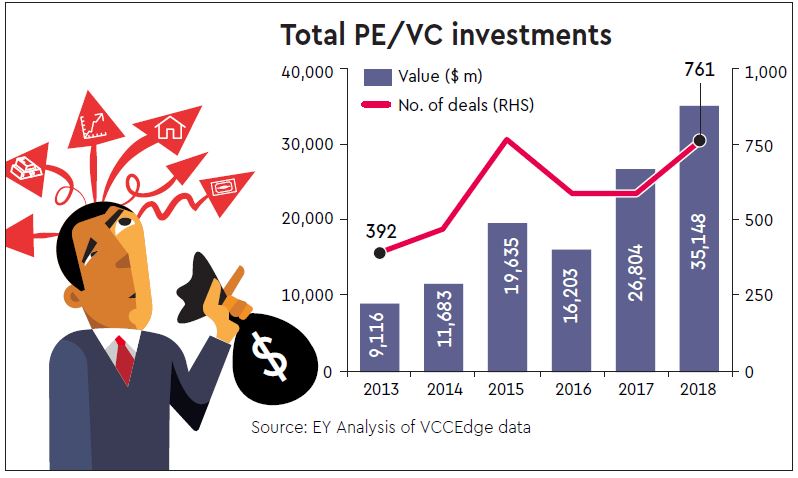

Private equity/venture capital investments stood at an all-time high of $35.1 billion in 2018, surpassing the previous high of $26.1 billion recorded in 2017 by 35% on the back of significant growth in large deals, according to EY’s private equity monthly deal tracker.

2018 recorded $8 billion-plus deals compared to 11 such deals in previous 12 years combined.

Vivek Soni, partner and national leader – private equity services, EY, said that 2018 has been the best year for PE/VC investments and exits.

“As forecast by us in the beginning of the year, both PE/VC investments as well as exits have touched a new record high in 2018. At $9.8 billion, value of buyouts in 2018 is almost equal to the value recorded in 2017, 2016 and 2015 combined. We believe this indicates growing maturity of the Indian PE/VC ecosystem where buyouts and large deals account for a major share of PE investments,” Soni said.

READ ALSO: Flipkart’s Sachin Bansal books $21 million ride in Ola

Financial services continued to be the top sector receiving $7.5 billion in investments across 141 deals, a 6% increase over 2017. Start-ups rebound in 2018 to record $6.4 billion in investments, 83% higher that the value recorded in 2017.

“Start-up investments also recorded a sharp rebound in 2018 and with the Walmart-Flipkart deal concluding successfully, there is renewed interest in the Indian start-up ecosystem and investors are more than keen to fund differentiated start-up business models driven by good quality management,” Soni said.

There were 76 deals of value greater than $100 million in 2018, aggregating to $25.9 billion and accounting for 74% of total PE/VC investments made in 2018 compared to 54 deals, aggregating to $18.7 billion, of value greater than $100 million in 2017. The value and volume of large deals has been progressively increasing over the past 4-5 years.

READ ALSO: Bajaj Finance slapped with Rs 1 crore penalty by RBI; here’s why

On the other hand, PE/VC exits, at $26 billion, increased by almost 100% compared to 2017 and are almost equal to the value of exits in the previous three years combined. The sharp rise was mainly on account of a single large deal that saw Walmart acquire controlling stake in Flipkart for $16 billion from a clutch of investors including Softbank, Tiger Global and others, the report said.

From a fund-raise point of view, 2018 saw $8.1 billion being raised across 51 fund raises by PE/VC funds; a 40% increase over 2017 and the highest ever.

READ ALSO: CPI inflation falls to 18-month low; declines to 2.19% in December

“In the long term, we see the Indian PE/VC market expanding significantly, given that we are currently at a very nascent stage when compared to global markets. We expect 2019 to also be a good year for PE/VC in India and potentially, even surpass the levels achieved in 2018 on the back of huge sums of dry powder of close to $40 billion (as per EY estimates) waiting to be deployed in India,” Soni said.