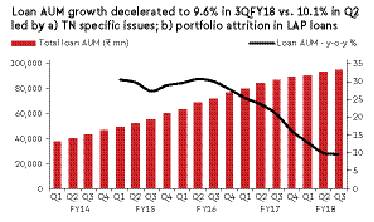

Q3 results disappointed on most counts. We believe normalisation of Tamil Nadu specific issues will take longer, which along with elevated repayment rates would weigh on loan growth. Spreads could moderate due to competition and repricing of back book. However, asset quality should improve. We trim our est. and expect 14% EPS CAGR over FY17-20e. At 2.3x FY19 BV (avg 3.3x BV), downside potential may be limited. Hence, we maintain Hold. Q3 PAT grew 4.4% y-o-y to Rs 485 mn, 14% below est: Loan book grew 9.6% y-o-y (Home loan 12% y-o-y, LAP 0.7% y-o-y), 2% below our est. Spreads fell 20 bps q-o-q. Cost to income rose to 18.9% (16.8% Q3 FY17) due to higher legal & advertising costs. Credit cost rose 11 bps q-o-q.

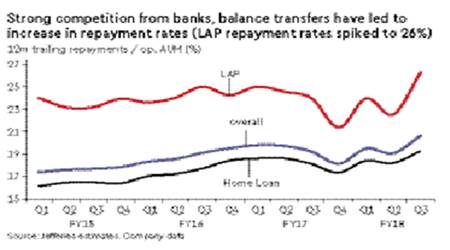

Loan growth disappoints; trim loan growth estimates: Home loan disbursal (+32% y-o-y off low base, -15% q-o-q) was affected by sand mining ban in Tamil Nadu by Madras High Court. Interim order by Supreme Court, staying the ban, should provide near term relief, but the issue may drag longer and regulations could get stricter, weighing on loan growth. Slow progress in regularisation of properties in unapproved plots and sharp rise in attrition especially in its large ticket loans against property (LAP AUM 0.7% y-o-y) due to competition from banks have also affected loan growth. We see these headwinds persisting and trim loan growth to 17% in FY 19e (19.5% earlier).

Spreads fell 20bps q-o-q; may moderate further: Yield surprised negatively (-40 bps q-o-q). Funding cost fell 10 bps q-o-q to 8.3%. Yield on incremental loans (HL 10%, LAP 12.8%) is lower vs. back book (HL 10.7%, LAP 13.8%). We expect yields to moderate further due to: (i) lower incremental yields; (ii) repricing of back book, and (iii) shift towards salaried segment (lower yields). Funding cost could decline too (incremental 8.16% vs. 8.3% in Q3), partly cushioning the impact. We forecasts spreads to moderate to 3% in FY19 (3.15% FY18e). Asset quality slips in Q3: GNPA rose 30 bps q-o-q to 3.7% led by 20 bps q-o-q rise in home loan GNPA (3.2%) and 70 bps q-o-q rise in LAP GNPA (5.9%). 28% of GNPA is in 90-120 days past due (dpd) bucket. Mgmt is confident of strong recoveries in this and expects GNPA to fall to 2% by Q4. Valuation/Risks: We trim FY18-19e EPS 1-4% factoring lower AUM, slightly lower spreads and higher costs. Our RI valuation based PT falls to Rs 570 (Rs 595), implying P/B of 2.3x FY1 BV (average 3.3x FY1 BV ex post). Risks: slower loan growth, higher NIM pressure, higher GNPA.