We initiate coverage of HEG with a Buy rating and PO of `6,700 — an upside potential of 110%, plus an 8.5% forecast dividend yield. It has seen a significant rise in profitability over the last 12 months as graphite electrode (GE) prices have risen fivefold. Chinese limits on steel production and efforts to cut pollution are lifting steel output by Electric Arc Furnaces (EAF). High entry barriers and limited needle coke supplies mean we see capacity staying tight and a multi-year period of high prices and profit. With 99% of revenue from electrodes, 2/3rd as exports, HEG is the purest play on the global sector.

Record earnings seen beating consensus estimates

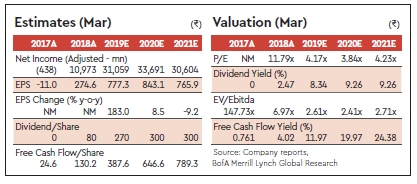

Net income is forecast at record Rs 31.3 bn this year – from Rs 11 bn in FY18. Q1FY19 net income was Rs 7.7 bn (24.6% of our FY forecast) versus a Rs 77 mn loss a year ago. GE prices are remaining firm and we see the company capable of passing on rising needle coke costs. Further upside is possible in our view as it lifts utilisation of its plant and benefits from a weak INR. Our estimates are 7/21% above consensus for FY19e/20e.

Strong cash flow—expansion and higher payout ahead

Debt free and generating operating cash flow of `16-33bn p.a., HEG’s balance sheet is strengthening rapidly with net cash/book equity seen reaching 50% by FY21e. It has announced its intention to expand its plant from 80K tpa to 100K for a maximum `7 bn. We expect it to maintain its 30-40% payout ratio implying an 8.5% dividend yield. Investing in related industries is possible, but we see limited options and instead look for further potential shareholder payouts.

Substantial value seen as multiples below prior troughs

The stock is trading at 3.8x P/E and 2.0x EV/Ebitda on FY20e – below peers in Japan and China. We attribute this to the current weakness of Indian equities and investors’ lack of conviction in the extent and longevity of the cycle. Our PO is set at average prior cycle peak earnings/ trough level multiples of 7.5x P/E and 5.2x EV/Ebitda for FY20e. Risks: an easing of China’s anti-pollution efforts, faster capacity additions, a weaker USD.

Buy, PO: `6,700 – 118% total return potential

Electrode pricing and profitability have improved significantly over the last 18 months. With new graphite electrode supply limited, we see this upcycle persisting for an extended period. HEG posted a record net income of `11 bn in FY18 with 89% of the profit coming in the second half. The earnings environment has improved further in recent months. We see the favourable outlook persisting in FY20e with net income forecast to rise another 8% to `33.7 bn.