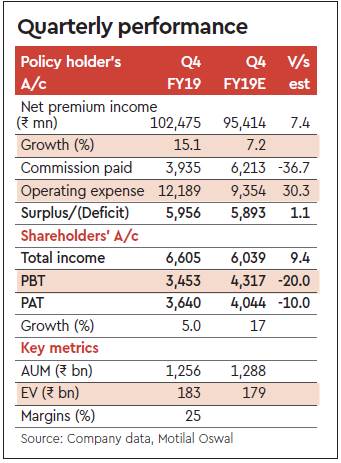

HDFC LIFE delivered a stable performance, with shareholder profits growing 5% y-o-y to Rs 3.6 bn. In Q4FY19, un-weighted premium increased 15% y-o-y (APE growth of 9% y-o-y), led by 27% y-o-y growth in single premium. For FY19, total premium/PAT grew 23.8/13.1% y-o-y to Rs 289/12.5 bn. For FY19, the share of the protection business increased to 16.7% of total APE (7% on an individual APE basis). Margins improved to 24.6% (v/s 23.2% for FY18), driving 20% y-o-y growth in VNB (value of new business) to Rs 15.4 bn.

Renewal premium growth at 13% YoY

Renewal premium growth stood at 13% y-o-y (17% y-o-y in FY19), as the persistency ratios held largely stable. The share of ULIPs in individual APE declined by 200bp y-o-y to 55%, while the composition of the non-par savings business increased sharply to 20% (+1100bp y-o-y), aided by sharp growth in the annuity business. HDFC LIFE continues seeing a significant potential in the annuity/ protection business and expects a further improvement in the product mix, which should support profitability.

Total commission and operating expenses

Total commission and operating expenses growth moderated to 6.9% y-o-y (16.5% y-o-y for FY19) to Rs 16.1 bn, while the total expense ratio was at 15.6%. The share of direct channel in individual APE stood at 19% v/s 14% in FY18.

Other highlights

(i) Bancassurance partner count increased to 266;

(ii) AUM grew 18% y-o-y to Rs 1.3 trn;

(iii) Solvency ratio stood at 188%;

(iv) Sold 36k policies in the annuity business with ATS of Rs 0.7 m over FY19.

Valuations and view

HDFC LIFE has delivered strong return ratios with average FY16-19 RoE/RoEV at 25+/21.1% respectively. We expect return ratios to remain strong on healthy new business margins, quality underwriting, and strong cost control. In FY19, HDFC LIFE reported operating RoEV/RoE of 20.1/24.6%, while EV increased to Rs 183 bn. We expect HDFC LIFE to deliver 26% CAGR in new business APE over FY19-21, while the margins are likely to improve at a calibrated rate to 26% by FY21. We, thus, estimate a 27% CAGR in VNB, with RoEV (return on enterprise value) sustaining at average 20% over FY19-21. We roll forward our estimates to FY21 and value HDFC LIFE at Rs 475 per share (3.6x Mar’21e EV). Maintain Buy.