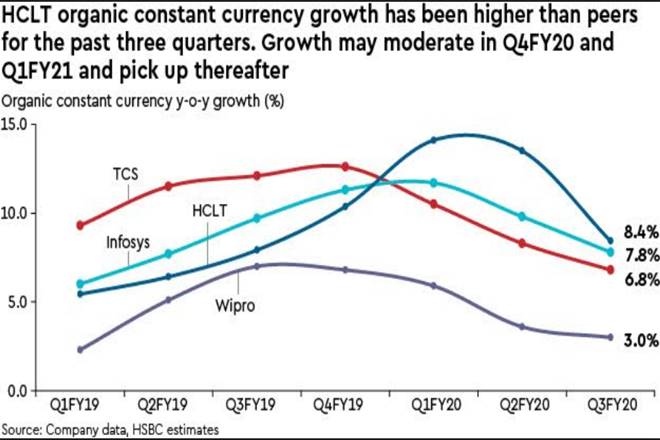

We recently interacted with HCLT management, to better understand the core business outlook, impact of COVID-19 and long-term potential of the products business. Deal signings and revenue growth both slowed down in Q2 and Q3. However, deal signings can be lumpy and management is already seeing an improving trend in deal signings. We think, Q4FY20/ Q1FY21 signings are likely to be in line with the trends before Q3FY20. In our view, revenue growth may decelerate (on y-o-y basis) in Q4 and Q1FY21. But full year FY21 cc organic growth should be c7%, which is in line with the industry average.

Products business is long gestation: We expect Products and Platforms (P&P) business to remain close to the current run-rate of $c1.3 bn for one year and then to slowly start to contribute to the overall growth. Considering that the acquired IBM products business has an extensive customer base (nearly 20,000), it is tough to make reasonable channel checks on the business, but we believe the current stock valuations don’t assume material success of the products business, which remains an upside risk to the stock.

Balance sheet decoded: HCLT’s balance sheet has been in focus for over a decade now. Earlier it was due to higher DSOs, thanks to the Infra business and now the intangibles from M&A and their amortisation treatment. HCLT’s DSOs is in line with the industry average and in fact improving. Secondly, the company is amortising the intangibles in around 6 years, which is in line with competition.

Impact of COVID-19 on the business: In Q4, some impact of COVID will be seen on the revenue growth, both in terms of demand and delivery, in our view. However, material impact could come in Q1FY21. In our view, around 40% of the HCLT business is exposed to verticals which are likely to be impacted by COVID – Retail, Tech, manufacturing etc, where businesses may be hit due to supply hit or demand fall. However, the real hit will come to new deal signings as decision-making has slowed down. Around 4% of the business comes from new customers/deals, which is likely to be hit in March and then Q1FY21.