We view HAVL as a multi-year growth story, backed by its varied product array, strong market share, new launches, distribution (130K retailers), nil D/E, robust Free cash flow firm (FCFF), sizeable cash pile (~Rs 22 bn estimates per annum) and sturdy return ratios (RoCE 30%+, RoE 20%+). Lloyd is amid an upgradation phase as well. While HAVL’s medium-term triggers remain robust, the current demand weakness and tight liquidity warrants near-term caution. We trim FY20/21/22e EPS by ~6%/4%/3%. Buy.

Core business: Around 60-70% of HAVL’s mix is B2C. Switches, Appliances (ECD) and Lloyd predominantly cater to B2C, whereas MCCBs, cables & wires and lighting cater to both B2B and B2C. Key medium-term drivers for HAVL’s business are—government impetus to housing, infrastructure, rural electrification, low organised penetration in select categories and consumer uptrend in discretionary. Also, HAVL is focused on consistent new launches, while enhancing its distribution reach. Near term catalyst could be the upcoming festive season (Q2,Q3 FY20).

Lloyd: HAVL is in the process of transitioning Lloyd to mass-premium segment from the earlier low-cost category. This led to interim market share loss in Q1FY20, but HAVL management is confident of improving it by Q4FY20e (Q2, Q3 are seasonally weak for ACs). Also, the recently commissioned AC plant is expected to ramp its in-house production to ~75% over near term.

Launches; innovation: Over past five years, HAVL has launched a slew of products: Water heaters (2012), Small appliances (2013), Pumps (2013), Air coolers (2016), Water purifiers (2017) and Personal grooming (2018). R&D spend stood at Rs 790 mn in FY19; +35% y-o-y, which stands at 0.8% of sales.

Distribution: HAVL enjoys pan-India reach, with 9K direct dealers, 130K retailers & 250K electricians. The next leg of growth could emanate from deeper focus on Tier 3 & rural. HAVL plans to double its retailer count to 200K over medium term, while also focusing on branded stores. To expand its channels, HAVL is increasing count of its branded stores (20% of mix ex-cables).

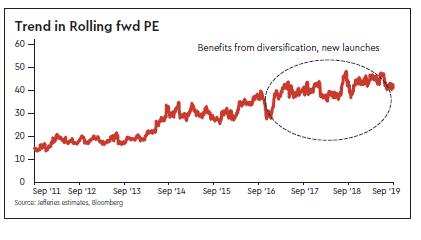

Estimates: Factoring in the current demand slowdown and tight liquidity in domestic market, we trim our FY20/21/22e EPS by ~6%/4%/3%, also noting the increasing competition in Panel TV industry (~25% of Lloyd’s topline). We expect revenue and margin traction to improve from H2FY20e. Over FY19-22e, we now pencil HAVL’s sales/PAT at ~13%/21% CAGR, driven by optimising mix, new launches, and ramp-up of in-house production in Lloyd.

Maintain Buy: We believe that a strong product slate, market share, robust structural drivers (holistic consumption play), entrenched distribution, new launches and a pristine B/S should continue to support HAVL’s premium multiples, now at 45x/35x/29x PE on FY20/21/22e. Maintain Buy with a revised price target of Rs 790.