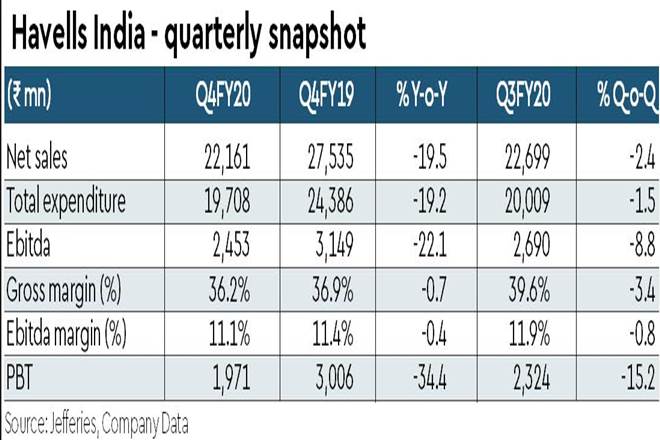

HAVL reported a subdued Q4, with sales/PAT dipping by -20%/-12% y-o-y, missing JEF and consensus estimates. While Jan-Feb witnessed a revival in consumer products, COVID contagion impacted demand from mid Mar’20. As cited by HAVL, ex-Covid, Q4 sales could have been +9%y-o-y (9MFY20 at -1%). Q4 op-margin was at 11.1% (11.4% in Q4FY19). Lloyd saw good traction till operations ceased in mid-March (q-o-q margin +160bps).

Highlights: Q4FY20: HAVL’s Q4 sales stood at Rs 22.2 bn (-20% y-o-y) with op-margin at 11.1% (-30bps y-o-y); PAT was at Rs 1.8 bn (-12%y-o-y). Ad-spend to sales dipped to 1.4% (3.7% in Q4FY19). Q4 is seasonally the strongest quarter for HAVL, generally accounting for 27%-30% of annual sales.

FY20: HAVL’s FY20 sales stood at Rs 94.3 bn (-6% y-o-y) with op-margin at 10.9% (-90bps y-o-y); PAT at Rs 7.3 bn (-7% y-o-y). As per company, ex-Covid, annual growth could have been +2% y-o-y.

Revenue: Q4FY20 segmental sales split was as follows: (i) Switchgears Rs 3.5 bn (-14% y-o-y); (ii) Cables Rs 6.8 bn (-24% y-o-y); (iii) Lighting Rs 2.6 bn (-23% y-o-y); (iv) ECD Rs 4.6 bn (-14%); and (v) Lloyd at Rs 4.6 bn (-14% y-o-y).

Contribution Margin: Q4FY20 segmental margin was as follows: Switchgears at 34.4% (39.3% in Q4FY19); Cables at 12.3% (17.5%); Lighting at 27.1% (25.9%); ECD at 24.6% (25.7%); Lloyd at 9.7% (15.0% y-o-y; 8.0% q-o-q). Margins declined due to under-absorption of manufacturing expenses amidst lower volumes. Cables margin was also impacted due to sharp fall in commodities and pricing pressure due to weak demand.

Balance Sheet: HAVL continues to showcase a robust balance sheet. As of Mar’20, the company exhibits nil leverage; net cash is at Rs 10.7 bn. Working capital improved to 38 days, compared to 42 days as of Mar’19.

Current Status: As cited by HAVL, operations are gradually being restored. Sales markets have resumed on a limited basis. A few plants have resumed operations, though with limited manpower. Few warehouses and offices have also opened.

Buy: HAVL has corrected by ~35% YTD and is currently trading at PE of 35x /28x on FY21/22e earnings. We currently have a Buy on HAVL with PT of Rs 660 (38x FY22 EPS). Key Risks: extended slowdown, subdued traction in Lloyd, RM volatility and pricing pressures.