Over the past three quarters, HAVL has consistently delivered superior sales growth, broad-based across categories & regions. In 9MFY19, its sales/APAT clocked 30/25% y-o-y, notwithstanding headwinds such as escalating competition, volatility in commodity prices & INR and adverse season. HAVL’s performance is ahead of peers, driven by a potent mix of diversified product slate, formidable market share, an array of new launches & entrenched distribution. Maintain Buy with PT of `830.

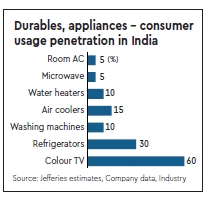

Bountiful industry opportunity: As cited by HAVL, India’s organised Electricals/Home Appliances industry (`450 bn/700 bn now) is likely to clock 12/15% CAGR over CY18-23e.

Consistent launches; spend on innovation: HAVL is positioned among the top 3 brands across most electrical & appliance categories, comprising 80% of its product mix. Over the past 5 years, HAVL has launched a slew of new products — water heaters (2012), small domestic appliances (2013), pumps (2013), air coolers (2016), water purifiers (2017) and personal grooming products (2018). R&D stands at 1% of net sales (`580 mn in FY18; 19% y-o-y). HAVL expects its R&D spend to rise to 3% of net revenue over the coming years.

Sturdy financials: We believe HAVL is poised for a multi-year growth trajectory, given its strong product mix, market share, distribution, unlevered B/S, robust FCFF (`7 bn p.a. avg. over FY19-21e), sizeable cash pile (`23 bn p.a. average over FY19-21e) and sturdy return ratios (RoCE at 30%+, RoE 20%+).

Over FY18-21e, we estimate HAVL’s sales/EPS CAGR at 17/22%, with 80 bps margin expansion to 13.7% by FY21e. Key risks: (i) subdued traction in Lloyd owing to extended winter, (ii) volatility in copper prices and (iii) higher competition & pricing pressures.