Picture this: You wake up one morning, check your portfolio, and find that a Chinese chipmaker you’d never heard of has surged 425% on its first trading day. A week later, another one jumps 693%. Sounds like a fever dream? Welcome to China’s semiconductor boom of 2025.

Moore Threads Technology – a company founded just five years ago by an ex-Nvidia executive – recently pulled off one of China’s most spectacular IPOs. But the real story isn’t just about eye-popping returns. It’s about a fundamental shift in how global investors view the AI chip race.

The DeepSeek awakening

Remember when DeepSeek shocked the world earlier this year by building AI models that rivaled ChatGPT at a fraction of the cost? That moment changed everything. Suddenly, investors realised China wasn’t just playing catch-up – it was innovating differently.

Now, fund managers from London to New York are asking: What if the same thing happens with chips? What if Chinese companies figure out how to build competitive AI processors without relying on cutting-edge Western manufacturing techniques?

Matt Toms from Barclays puts it bluntly: “It wouldn’t surprise me if in 2026 or 2027 we have a DeepSeek moment for chips.” That possibility has investors scrambling to get exposure before it’s too late.

Why the sudden interest?

Three forces are colliding to create this investment frenzy.

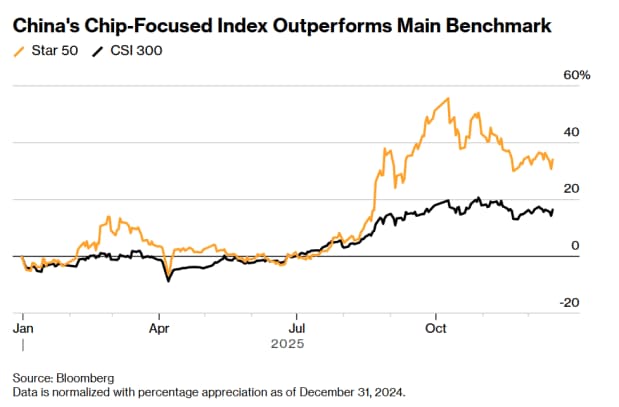

First, there’s the valuation gap. The tech-heavy Nasdaq trades at 31 times earnings, while Hong Kong’s tech index sits at just 24 times. Chinese AI chip stocks suddenly look like bargains compared to their American counterparts, especially as concerns grow about a bubble in US tech valuations.

Second, Beijing is going all-in on semiconductor self-reliance. When Washington blocked advanced chip exports to China, it inadvertently created a massive protected market for domestic players. Companies like Biren, Iluvatar CoreX, and Enflame Technology now enjoy policy support, emergency financing, and guaranteed demand from tech giants like Tencent, Alibaba, and Baidu who are being pushed to phase out Nvidia.

Third, there’s diversification anxiety. UK-based Ruffer has “deliberately limited exposure” to the Magnificent Seven US tech stocks and is betting on Chinese AI instead. Their logic? The competitive moat protecting American chip dominance might not be as wide as everyone thinks.

The IPO Parade

The pipeline is remarkable. Biren Technology is targeting a $600 million Hong Kong IPO. Baidu’s chip division Kunlunxin is considering going public at a $3 billion valuation. Memory chipmakers GigaDevice and Montage are each seeking to raise up to $1 billion. ChangXin Memory and Yangtze Memory are eyeing valuations as high as $40 billion.

These aren’t just small startups. Many are already domestic leaders in their niches – memory interfaces, micro-controllers, advanced NAND flash. What they lack is international recognition, which makes these listings crucial tests of global confidence.

The reality check

But here’s where it gets interesting. Not everyone’s convinced. Some fund managers warn that Chinese chip stocks are “almost entirely driven by hype” with no valuation support. The technology gap remains real – Moore Threads’ chips are still considered second-tier compared to Huawei’s HiSilicon or market leader Cambricon.

And there’s the uncomfortable truth: short-term, US export controls are working. Chinese firms are training AI models on less capable hardware, widening the performance gap. But long-term? Those same restrictions are forcing China to “pump money into hard technology and invent from scratch,” potentially accelerating innovation.

Our take

This isn’t a simple bull or bear story. It’s a bet on fragmentation. Global investors are realizing that the AI chip market is splitting into two parallel universes – one dominated by Nvidia and US technology, another developing independently in China.

The question isn’t whether Chinese chips will match Nvidia’s Blackwell tomorrow. It’s whether they need to. With a protected domestic market, state backing, and advantages in manufacturing and engineering, Chinese chipmakers might carve out their own path.

For investors, the prudent play might be exactly what fund managers are doing: balancing exposure across both ecosystems, because in a geopolitics-driven chip cycle, nobody knows which side will pull off the next breakthrough.

( Sonia Boolchandani is a seasoned financial writer She has written for prominent firms like Vested Finance, and Finology, where she has crafted content that simplifies complex financial concepts for diverse audiences.)

Disclosure: The writer and her his dependents do not hold the stocks discussed in this article.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.