Escorts’ revenue declined ~5% y-o-y to Rs 13.2 bn (our estimate: Rs 13.5 bn), led by lower volumes in Tractor (-6% y-o-y) and Construction Equipment (-21% y-o-y) segments. Railway revenue grew ~20% y-o-y. Tractor realisations declined 2.8% q-o-q (+1.7% y-o-y) to ~Rs 504k due to a weaker mix. Ebitda margin of 9.6% (our estimate: 9.8%) was impacted by operating deleverage and an adverse mix in Tractor/Rail. PBT declined ~24% y-o-y, but lower tax drove PAT growth of ~10% y-o-y to Rs 1.1 bn (our estimate: Rs 1 bn). Tractor segment PBIT margin shrank ~440bp y-o-y (-60bp q-o-q) to 10.3%.

1H performance: ESC reported positive CFO of ~Rs 3 bn (v/s negative ~Rs 2.7 bn in 1HFY19), led by lower working capital. FCFF was at ~Rs 2 bn (v/s – Rs 3.4 bn in 1HFY19). Revenue/ Ebitda/ PAT declined ~6%/21.5%/9.5% y-o-y.

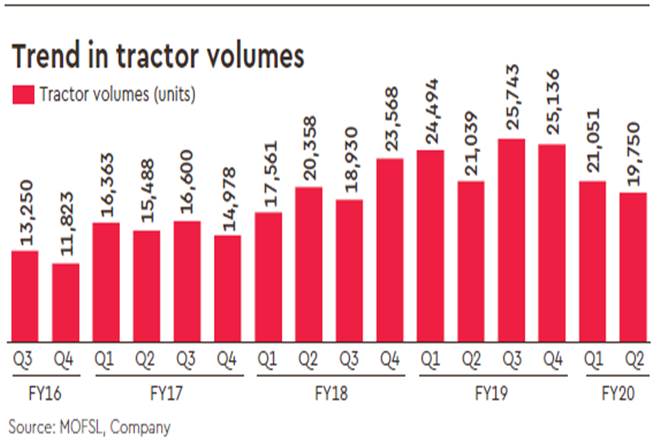

Earnings call highlights: Industry volumes declined 10% y-o-y. ESC’s strong markets declined by ~2% and opportunity markets (east, south and west) by ~18%. Dealer inventory was at <4 weeks as of Oct’19 (below normal), whereas inventory with company stood at 2 weeks. FY20 industry volumes are likely to decline in single digit (implied flat volumes for 2H). A full-fledged recovery might be seen from Mar’20 or May-Jun’20.

The recovery was good in the festive season, though lower on a y-o-y basis. Industry de-grew by 15% in Apr-Aug and 5% in Sep-Oct. Momentum is expected to continue in Nov’19. It added 45 new dealers (to over 950 dealers) in Q2. Rail order book stood at ~Rs 5 bn. Margins in 2H are likely to be better than 1H with inventory correction now behind the company.

Valuation view: We upgrade our FY21e EPS by ~5% as we factor in higher tractor volumes in wake of good monsoon. The stock trades at 12.3x/10.8x FY20/21e EPS. Maintain Neutral with a TP of ~Rs 700 (~11x Sep’21 EPS).

Market share gains in tractor business to continue: With good monsoon, industry volumes are likely to recover in FY21. We expect ESC to gain market share backed by gains in its opportunity market, coupled with a gradual improvement in the company’s competitive positioning in its traditional market due to plugging of product gaps. We expect ESC to continue outperforming the domestic tractor industry volume, with ~5% CAGR over FY19-22.

EPS trajectory over FY19-22: With market share expansion in the core tractor business and healthy traction in the CE and railway businesses, we estimate revenue CAGR of ~5% over FY19-22. We expect ESC’s margins to expand ~20bp (over FY19-22) to ~11.8%. Consequently, we expect EPS CAGR of 8%. Our estimates are not yet factoring in any contribution from the Kubota JV.