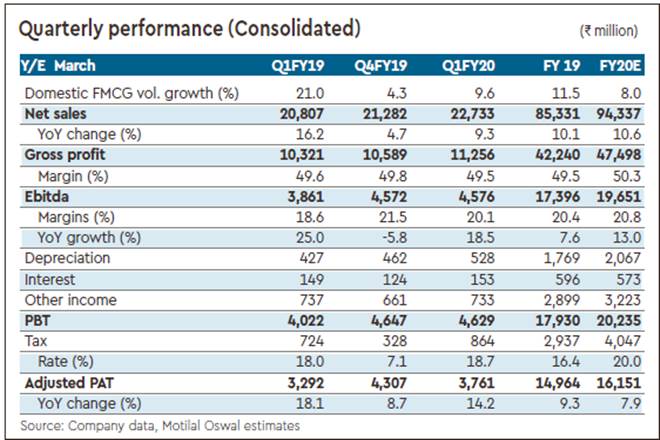

Consolidated sales grew

9.3% y-o-y to Rs 22.7 bn (v/s est. of Rs 22.2 bn). Ebitda grew 18.5% y-o-y to Rs 4.6 bn (v/s est. of Rs 4 bn). Adj. PAT increased 14.2% y-o-y to Rs 3.8 bn (v/s est. of Rs 3.4 bn). The domestic FMCG business grew 10.5% with underlying volume growth of 9.6% (v/s est. of +2%). Gross margin contracted 10bp y-o-y to 49.5%; this along with lower staff cost as % of sales (down 60bp y-o-y to 10.2%), ad spends as a % of sales (down 70bp y-o-y to 8.9%) and low other expenses as % of sales (down 40bp y-o-y to 10.3%) meant that Consolidated Ebitda margin expanded 160bp y-o-y to 20.1%. Standalone Sales, Ebitda and Adj. PAT grew 10.5%, 23.3% and 17.5%, respectively. Ebitda margins expanded 200bp y-o-y to 19.4%.

Concall highlights

(i) Despite good sales growth in the domestic business in Q1FY20

(+10.5%) y-o-y, management has refrained from giving double-digit sales growth guidance for the full year, given the sequential slowdown, channel liquidity crunch and competitive intensity in some categories, (ii) Raw material costs remained benign; we do not expect them to rise in the near term, (iii) Target of maintaining full-year 20% Ebitda margin.

Valuation and view

Results for the quarter were ahead of our estimate. But cautious commentary on the demand environment has led to minor changes in our full-year estimates. We have increased FY20/FY21 EPS forecasts by 1%/0.4%. Valuations are fair at 41x FY21, particularly for a business with moderate earnings growth prospects (~10.2% CAGR over FY19-21) and ROCEs in mid-20’s that are inferior to peers. Earnings trajectory could be better than expected if rural growth surprises positively and from potential sharpening of focus under a new CEO. We maintain Neutral rating with a TP of Rs 425 (targeting 40x Jun’21 EPS).