COAL’s Q1 volumes were 5% above Q1FY20 but cash Ebitda was 39% lower (39% below JEFe) led by lower realisations and higher costs. Volume growth has improved in recent months and COAL might take a price hike in FY22; however, rising staff cost due to workers’ wage revision is posing a headwind. EPS has been almost flat over FY13-20 and we see just 2% CAGR over FY21-23. The sharp rise in capex is also dragging cash flows. We fine-tune estimates and retain Hold.

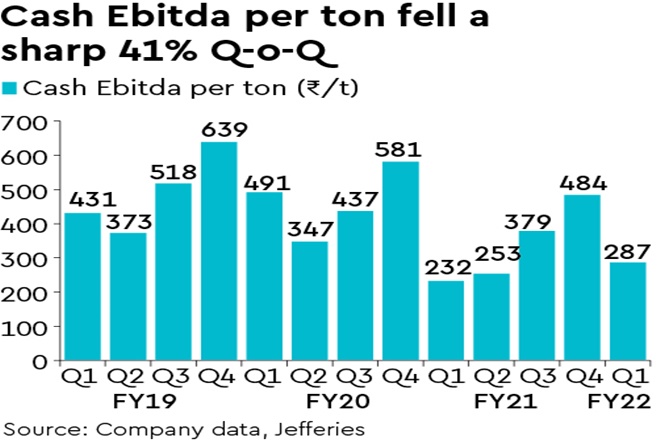

Ebitda miss in Q1: COAL’s Q1 dispatch volumes were 5% above Q1FY20 but ASPs were 4% lower due to weaker e-auction realisations. Reported Ebitda was 27% below Q1FY20. Excluding the non-cash stripping-activity-adjustment expense, cash Ebitda was 39% below Q1FY20. Cash cost/t rose 14% vs Q1FY20 while cash Ebitda/t was 42% lower. FSA volumes were down 4% q-o-q while FSA ASP were flattish q-o-q. Q1 e-auction volumes grew 4% q-o-q while e-auction ASP declined 10% q-o-q. Q1 PAT was down 31% q-o-q (32% below Q1FY20).

Volumes picking up and possibility of price hike: COAL’s dispatch volumes fell 6% over FY19-21 due to weaker economy and Covid, but have started to pick up; April-July 2021 dispatches are 5% higher than 2019 (July +8%). We factor in shipments growing 12% y-o-y in FY22 on a low base, followed by 5% growth in FY23. Production also picked up in July, rising 11% above 2019. We believe a price hike for linkage coal may be on the anvil as the company usually raises prices close to wage revisions. We have assumed 5% hike in H2FY22 in our estimates.

Cost headwinds hurting margins: COAL’s wages revision has been due from June 2021. Our estimates factor in staff costs rising 24% over FY21-23. COAL’s cash Ebitda/t is down from Rs 483 in FY19-20 to Rs 349 in FY21 and we expect Rs 377-402 in FY22-23 (Q1FY22: Rs 287).

Cash flows under pressure: COAL plans to incur capex of Rs 160-170 bn in FY22-23 vs an average of Rs 73 bn over FY16-20. COAL believes current spend is better reflective of business requirements. COAL generated negative FCF in FY20-21 and we expect a subdued Rs 14-34 bn in FY22-23 versus Rs 70-125 bn in FY17-19.

Valuation too cheap for a cautious view: The stock has underperformed Nifty-50 by ~100% since Jan-2018, and its 6.7x FY23E PE is undemanding. It also offers 9% dividend yield assuming 60% payout, although this will be partly funded by cash on the B/S. The stock is unlikely to re-rate though given multiple operational challenges, deteriorated cash flow profile, large contingent liabilities and ESG concerns. We fine-tune FY22-23e EPS and retain Hold with Rs 135 PT based on 6.0x FY23e PE.