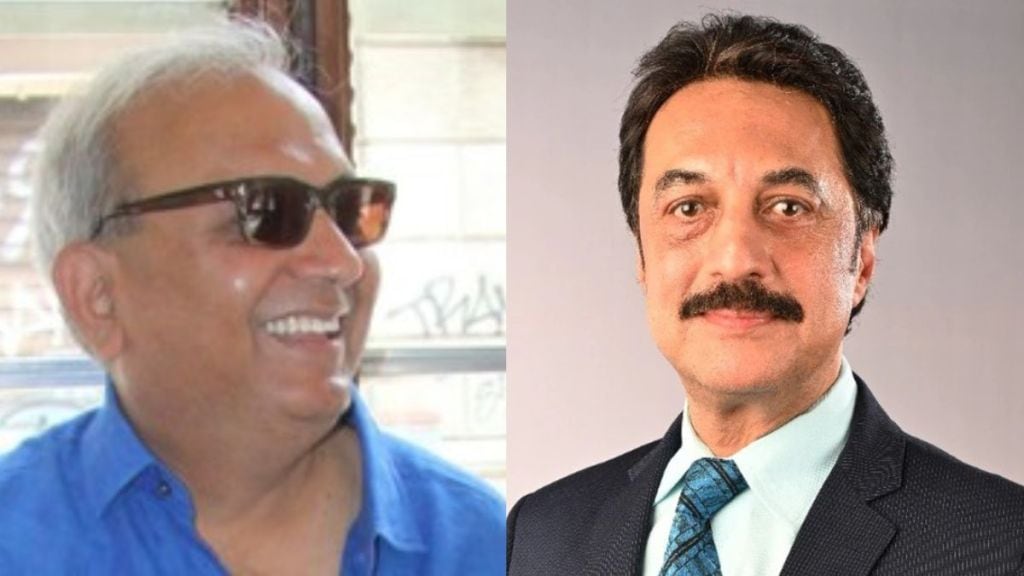

The Indian stock market has been on a roller-coaster ride, leaving investors uncertain about what’s next. Is the bull run still alive, or is the market entering a long bearish phase? Two of India’s most renowned market experts- Shankar Sharma, founder of GQuant Investech, and Samir Arora, founder of Helios Capital- debated this hot topic at the Moneycontrol Global Wealth Summit 2025.

While Sharma is known for his skeptical outlook, Arora remains an optimist about India’s equity landscape. Their fiery discussion had the audience hooked as they dissected the state of the Indian stock market.

The tired bull versus the running bull

At the Moneycontrol Global Wealth Summit 2025, Shankar Sharma said that the India’s bull run is exhausted. “An Indian bull can run for five years, while bulls in America can run for ten years,” he added. According to him, the stock market’s rally over the past five years has been rapid, leaving the bull “tired” and vulnerable.

“The bull run over the past five years was a fast one. So that bull is a tired bull. And a tired bull will fall at the slightest hint of trouble, while a young bull will jump over it,” Sharma noted at the event.

Furthermore, he explained that when markets get tired, any economic uncertainty can push them down. “I have been bullish for 4.5 years, but I always believe markets are cyclical. The data proves it. Therefore, I turned,” he added.

Arora fires back: “It’s still a bull run”

Samir Arora, known for his bullish stance, on the other hand disagreed with Sharma’s outlook. “Mr. Shankar Sharma’s convenient choosing is of the last five years. However, over the past 7 years, 9 years, 11 years, 13 years, 15 years, 20 years, and 25 years, they all look the same,” he countered.

For Arora, defining a bull run is not just about short term market moves but about overall economic performance. “One: I should do better than what other asset classes are doing, which means debt primarily. Two: Broadly, we should do better than what other countries are doing. From that angle, this is still a bull run,” he added.

Is India the only bear market?

Sharma took his argument a step further by stating that India is experiencing a bear market, not because of global trends but due to domestic issues. “China is doing well. Obviously, Europe is doing phenomenally well. Toh India mein hi hai (The bear market is only in India),” he said.

He also pointed out that returns in small-cap funds have dropped. Historically, they have yielded 14-15% over 25-30 years, but now, due to slower GDP growth, the returns have shrunk to 10-11%. “Markets have exhausted their reserves, and lower returns are a reality now,” Sharma explained.

Where is the market headed?

Despite their differing views, both Sharma and Arora noted that the market’s next moves will depend on key global and domestic factors. Arora believes that while there may be corrections, the market could bottom out in the next one or two months and bounce back by 5% to 10%. However, he dismissed the possibility of a sharp V-shaped recovery.

Sharma, on the other hand, painted a grim picture, stating that the Nifty 50 won’t see any new highs in 2025. “There will be next to zero returns from the September 2024 highs for the coming four to five years,” he noted.