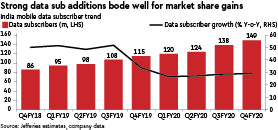

Bharti Airtel’s Q4FY20 results surprised positively with India mobile ARPUs rising by a sharp 14% q-o-q and strong 10 m data subscriber additions despite sharp tariff hikes. Bharti’s ability to attract data subscribers should support market share gains. We raise our FY21-23 forecasts by 3-6% and reiterate Buy with revised target price of Rs 660/share.

Highest revenue growth in 10 years: Bharti Airtel’s Q4FY20 results were encouraging with consolidated revenues up 8% q-o-q, its highest in a decade and ahead of estimates. Consolidated Ebitda was up 10% q-o-q, in line with estimates, driven by 80bps q-o-q jump in margins to 43%. Consolidated loss of Rs 52 bn disappointed due to exceptional losses of Rs 70 bn on the back of Rs 8 bn interest on AGR liabilities and Rs 58 bn related to one-time-spectrum charges.

India mobile revenues/ARPU at 12 quarter high: Bharti Airtel’s India mobile revenues at Rs 129 bn, up 16% q-o-q, were 6% ahead of estimates and the highest in 12 quarters. ARPUs grew 14% q-o-q to Rs 154, ahead of estimates led by tariff hikes and strong traction in data subscribers to 149 m (+10 m q-o-q) and data usage to 14.6GB/month (up 35% y-o-y). Strong revenue growth drove 330bps q-o-q expansion in margins and 27% q-o-q jump in Ebitda. Gross subscriber additions were strong at 22.5 m.

Strong growth in non-mobile business: Non-mobile segments results were also encouraging with homes business reporting 2% q-o-q ARPU growth. the first in 20 quarters. Digital TV also reported healthy growth in both subscribers (+8% y-o-y) and underlying ARPUs (7.5% y-o-y). Airtel Business revenues grew 2% q-o-q. Africa missed estimates, comfortable leverage: Africa revenues (up 2% q-o-q) missed estimates due to lower than expected ARPUs. Africa’s net debt was stable at $3.6 bn and leverage is under control at 2.3x Ebitda.

Improving ROCE, AGR dues hit cash flows: During FY20, while Bharti Airtel’s consolidated Ebitda grew 42% y-o-y, its cash flow from operations at Rs 181 bn were down 8% y-o-y due to the Rs 177 bn paid by Bharti Airtel towards part AGR dues. However, 30% y-o-y fall in capex, resulted in lower FCF burn of Rs 150 bn in FY20. ROCE nearly doubled y-o-y to 3% driven mainly by margin expansion. Bharti’s net debt of $16 bn remains manageable, given comfortable gearing ratio of 3x.

Raise forecasts/target: We raise our FY21-23 India-mobile ARPU estimates by 5-6%, which lifts our FY21-23

consolidated revenue and Ebitda estimates by 3-6%. Maintain Buy.