Weaker asset quality overshadowed what was a decent operating performance marked by tighter cost control. Quarterly earnings are likely to be volatile as the bank deals with the remnants of a painful corporate NPL cycle; Q1 had a bunched up impact, but we reckon credit costs should normalise (mgmt guidance of sub 100 bps by FY22). Capital raising, at some point in next few quarters, should aid NIM and growth. We maintain Buy with a revised TP of `885.

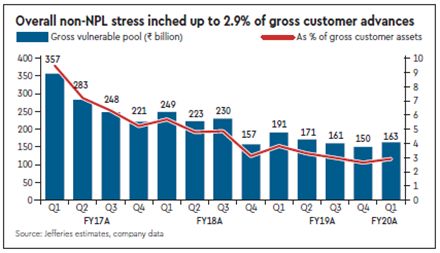

Asset quality: The bank made internal rating downgrades across a bunch of group companies aggregating `22.4 bn, while new NPL formation were elevated at `48 bn. We estimate the gross vulnerable pool at `163 bn (2.9% of gross customer assets), against which a contingent provision of `23.6 bn has been created, resulting in a net vulnerable pool of `139 bn (2.6% of net customer assets). The gross pool consists of `75 bn of BB & below loans, `9 bn of corporate bonds, `53 bn of non-funded exposures to NPLs/BB & below, and ~`26 bn spread across 8 group companies—we have excluded exposure to DishTV (`20 bn) & non-fund exposure to RCOM (`21 bn). Provisions were bunched up and elevated. Gross and net NPA was flat sequentially at 5.25% and 2.04%. Retail and SME slippages were also slightly elevated (net slippage ratio of 1.9% vs 1.6% in Q1FY19).

Margins: NIM came at 3.4%, 6 bps lower sequentially. Higher NPL led to 10 bps loss on interest reversals. The faster pace of growth in retail term deposits, and lower CASA growth is also a drag. Management guides for a flat to positive bias in FY20 and expects NIM to hit the ceiling of 3.5-3.8% guidance by FY22. This improvement necessitates a granular liability franchise, better asset mix, higher equity float (and hence a capital issuance) and importantly, a conducive growth environment.

Loan growth: Net loans grew at 12.7% y-o-y, bank’s approach being to grow cautiously in SME (+8.1% y-o-y) and corporate (+2.9% y-o-y). Retail loans grew 22% y-o-y. Personal & card loans (+48.1% y-o-y) and auto loans (+33.1% y-o-y) were the strongest segments in the retail loan book.

Retail term deposits (RTD): The liability profile remains strong, with CASA and retail term deposits comprising ~81% of total deposits. The CASA ratio was 41%. Management specifically highlighted the focus on ramping up the retail term deposit market share.

Estimate: While we push core PPoP higher for FY20, but it’s offset by higher credit costs (higher by ~90 bps) driven by a weaker macro and liquidity issues around promoters/corporates. We also marginally increase credit cost in FY21 by 5 bps keeping FY22 flat and tweak core PPOP by 1-2%, resulting in a 6-8% cut in EPS. We haven’t penciled in any capital issuance. We forecast a 12% adj. BV CAGR over FY19-21e. The stock trades at 2.3x trailing and 2.1x fwd. P/B and 16.9x fwd P/E. We roll fwd to Jun’20, and value the stock at 2.6x P/B (15.7x P/E) with comparable 10 year average of 2.4x P/B and 14.4x P/E respectively.