Q3FY19 revenue/EBITDA growth of 24.3/17% y-o-y came ahead while 14.6% y-o-y PAT growth was in line with estimates. Despite the benefit of festive shift, decorative volume growth of 23% y-o-y is robust and is a reflection of market share gains post GST with steady demand environment. Margins, on the other hand, have bottomed out making APNT one of a select few to witness both strong topline and bottomline traction. Maintain Buy with TP of `1,620.

Decorative paints

APNT standalone paints business grew 26.6% y-o-y during Q3FY19 on a base of 11.1% y-o-y growth. This growth was led by strong double-digit volume growth (23% y-o-y) albeit on a soft base of 6% y-o-y volume growth in the base quarter. This volume growth is highest in at least 8 years. Management highlighted that the strong performance was across regions, arresting concerns of market share loss.

Home improvement

Consolidated home improvement business (Ess Ess and Sleek) grew 23.2% y-o-y; however, standalone business growth (Ess Ess) grew softer at 11.3% y-o-y. Growth was helped by the increase in distribution and product portfolio. Losses in this segment increased to `171 m in Q3FY19 as against `67 m in Q3.

International, industrial and autos

Softer growth in international business dragged standalone growth. Performance in auto JV (PPG-AP) was impacted by slowdown in auto OEMs. However, industrial JV (AP-PPG) saw good growth.

Margin

Consolidated gross margin dipped 127bps y-o-y (though increased 116bps q-o-q) while Ebitda margin dipped 122bps y-o-y. Standalone gross margin dipped 147bps y-o-y (jumped 125bps q-o-q) while Ebitda margin was down 107bps y-o-y. Jump in other expenses (up 22bps y-o-y) was led by increased marketing costs while staff costs were impacted by higher labour cost of the new plant and increase in retirement benefits due to a lower interest rate.

PT and view

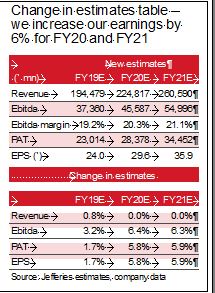

We increase our EPS ests for FY20 & FY21 by 6% to factor better margin traction assuming stable raw material prices. We expect APNT to sustain strong trajectory of volume growth which will potentially outpace our staples universe. Gross margins at a multi-year low have bottomed out leaving scope of margin expansion in the medium-term post new plant ramp-up. We roll over to FY21e EPS to arrive at a PT of `1,620 (still valuing at 45x P/E).