Despite COVID-19 disruptions, GNP reported revenues of Rs 27.7 bn in Q4, which grew 8% y-o-y as it benefitted from customers stocking up in India to avoid supply uncertainties. India sales at Rs 7.6 bn grew 14.5% y-o-y. It also benefitted from additional supplies in Italy. Gross margins (GM) at 64.7% fell 170bps y-o-y as it continues to face price erosion in its US derma portfolio. Despite lower GM, its Ebitda margin at 16.8% improved 262bps y-o-y on tight control of other operating costs (incl. R&D). Reported PAT at Rs 2.2 bn (+36.3% y-o-y) included a one-off benefit of Rs 329 m.

Near term will be challenging: Q1FY21 will be challenging for most of its segments due to COVID-19, according to GNP. It expects a gradual recovery in growth for key markets like India and the US. Ichnos Sciences (its innovation business) has initiated a process to raise capital in the US. A successful capital raise will significantly ease R&D burden for GNP.

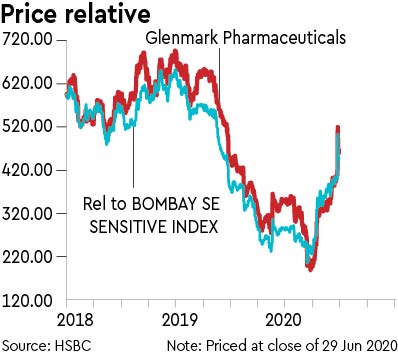

Downgrade to Hold: GNP’s stock price has risen 35.3% in 2020 YTD (including a single day gain of 26.97% on 22 June on FabiFlu approval by the Indian regulator as an emergency treatment for COVID-19) vs a decline of 15.4% for Sensex. We believe this largely factors in upside from an expected operational turnaround and debt reduction, where GNP is yet to show results. We believe further re-rating would need to be backed by notable improvement in execution.

We downgrade GNP to Hold from Buy as we look for improved execution. We make minor changes (2-3%) to our FY21-22 estimates after Q4 results. We value GNP’s base business by discounting our one-year forward fair value estimate. To the base business value, we add our NPV forecast for the R&D pipeline to arrive at our TP of Rs 475 (from Rs 360).