APHS has seen a significant decline in patient footfalls on the back of the 21-day nationwide lockdown. Except for emergency cases, both in-patients (IP) and out-patients (OP) volumes have dried up. Due to the postponement of elective surgeries, IP volumes declined by 35-40% to 700-800 admissions per day (vs normal run rate of ~1,200). OP volumes declined by ~90% to 600 registrations per day (vs normal run rate of 6,000 day). Overall bed occupancy has fallen to 40% compared to 69% occupancy at the end of Q3FY20 (APHS cannot cover its operating costs at occupancy below 50% and faces cash burn).

APHS does not expect a significant impact on Q4FY20 financials; however, it sees a larger hit in Q1FY21 due to the lockdown. Along with a decline in domestic OP volume (which acts as main feed for its IP admissions), high-yielding international patients volume (~10% of its IP revenues in FY19) has also dried up.

Q4FY20 preview: We expect IP volume to remain muted for key Chennai and Hyderabad cluster hospitals at 1-1.6% y-o-y range in Q4. Due to lower occupancy and case mix change (lower elective surgeries), we expect overall revenues and Ebitda to decline by 6.3% and 16.9% q-o-q (y-o-y not comparable) on standalone basis.

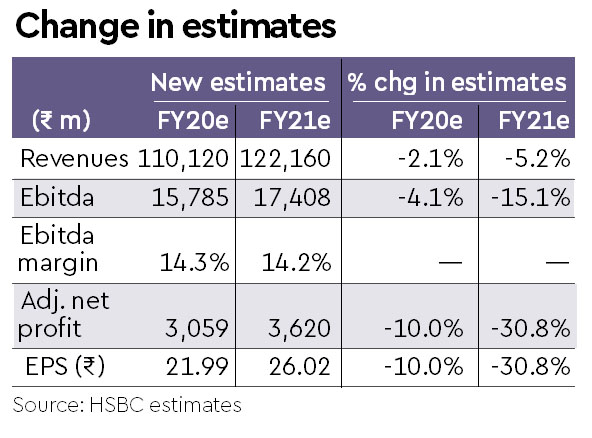

Maintain Buy: To reflect near-term disruption in the hospitals business, we cut our Ebitda estimates by 4.1/15.1/4.5% for FY20/21/22 respectively. We expect APHS to see normalising operations towards the end of Q1FY21. Despite volatility near term, we believe the long-term outlook for its core hospital business is intact. APHS has no major capex need in the next two to three years. Our DCF driven TP falls to Rs 1,550 (from Rs 1,875) on lower estimates and changes in other DCF inputs.