It has been three weeks since Donald Trump assumed office in his second term as the US President on January 20. In the mere period of over 20 days, the Trump policies have fazed the world into a cautious fallout. As unpredictable as these weeks have been, they also remind Asia’s richest families of their future with Trump’s administration.

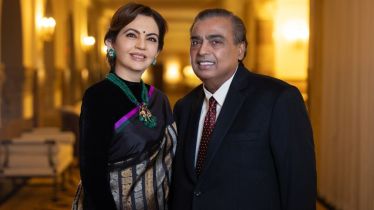

With industry giants like Ambanis (reigning No.1), Kwok’s, and Birla’s on the list, the diverse conglomerates foresee the risk of a tarriff storm dominated by the Trump regime. Here’s a complete list of Asia’s top 20 richest families.

| Rank | Name | Country | Company |

| 1 | Ambani | India | Reliance Industries |

| 2 | Chearavanont | Thailand | Charoen Pokphand Group |

| 3 | Hartono | Indonesia | Djarum, Bank Central Asia |

| 4 | Mistry | India | Shapoorji Pallonji Group |

| 5 | Kwok | Hong Kong | Sun Hung Kai Properties |

| 6 | Tsai | Taiwan | Cathay Financial, Fubon Financial |

| 7 | Jindal | India | OP Jindal Group |

| 8 | Yoovidhya | Thailand | TCP Group |

| 9 | Birla | India | Aditya Birla Group |

| 10 | Lee | South Korea | Samsung |

| 11 | Zhang | China | China Hongqiao, Shandong Weiqiao Textile |

| 12 | Cheng | Hong Kong | New World Development, Chow Tai Fook |

| 13 | Bajaj | India | Bajaj Group |

| 14 | Pao/Woo | Hong Kong | BW Group, Wheelock |

| 15 | Kwek / Quek | Singapore / Malaysia | Hong Leong Group |

| 16 | Kadoorie | Hong Kong | CLP Holdings |

| 17 | Chirathivat | Thailand | Central Group |

| 18 | Hinduja | India | Hinduja Group |

| 19 | Sy | The Philippines | SM Investments |

| 20 | Lee | Hong Kong | Lee Kum Kee |

With five major conglomerates from India, Ambani’s have topped the chart with a combined net worth of over $90 billion. A pioneer in the AI sector in India, Ambanis have made large investments in data centres, enterprise software and AI-driven apps. In top five, India’s Shapoorji Pallonji Group stands at the fourth rank with over $35 billion to its name though most of the family fortune is illiquid.

Other Indian families like the Bajajs, Jindals, Birlas and Hindujas have also made the list published by Bloomberg. Five families stand in the list from Hong Kong itself. With diverse industry backgrounds like property, retail, energy supply, shipping and jewellery these families have a combined net worth of more than $100 billion.

A notable development of the report is suggested by the absence of the Adani Group. It is suspected that the ‘dynastic-specific’ ranking has left out the first-generation businessman such as Alibab Group’s Jack Ma as well.

The tariff threats and unpredictable policy updates have created a situation of stress among the wealthy. Global relations and bilateral agreements playing a major role in the potential effects of the policy changes.