By Srivatsa Krishna

This is perhaps the best ‘I told you so’ book that every policy maker in the world must read. Nouriel Roubini, who went from being called the prophet of doom to the prophet of the future, has written a brilliant book listing 10 mega threats, which, according to him, are almost certain to happen unless an impossible confluence of circumstances ensures that they don’t. The book is extremely pessimistic about the possibility much less the probability of such a confluence of circumstances happening and that leaves one with a dismal and even terrifying message, but one worth reading and pondering deeply over. The cynic of today is often the realist of tomorrow.

Optimism, and with it an optimism bias, are deeply ingrained in the human DNA. Most of us when we wake up think of a better future, and our decisions and judgments every single day run on that hope. While there is nothing wrong in doing so, it is always sensible and realistic to keep an eye on the potential risks that can detail the optimism bias that all of us carry within us.

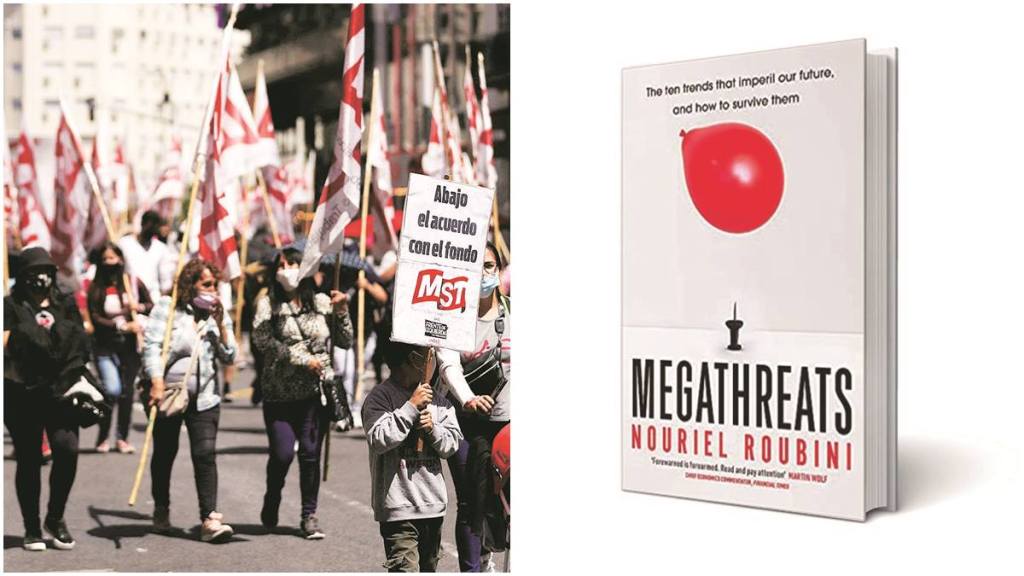

Roubini argues a scary economic future by predicting that every country is an Argentina in waiting and that the mother of all debt crises will happen in the next 10-20 years, all within one generation. Argentina, the poster child of global financial delinquency, has defaulted on its debt nine times since its independence in 1816. By the end of 2021, global debt, both public and private taken together, exceeded 420% of the planet’s gross domestic product (GDP), and is only rising.

Also Read: Smart home decor : Technology offers a slew of home decor options

Global estimates suggest that this does not include the $80 trillion of unfunded or underfunded pension liabilities of just the top 20 economies of the world.

Whether the capital structure of every country, their respective macroeconomic environments, their interest rates regime, policy design and political economy will all make them an Argentina over time is debatable, but his arguments are indeed persuasive.

The book speaks about the perils of inflation and stirs up memories of the Great Inflation of the 70s which led to it peaking at 14% in 1980. This was followed by the Great Moderation which brought relative price stability for a while. He argues that we’re going to an era of the great stagflationary (a stagnant economy combined with inflation) and debt crises.

The book argues, and correctly so, that it matters exactly how governments and private sector agents borrow. The absolute numbers, of course, matter, but the tools that produced those numbers are themselves cause for alarm. Three epic mismatches, as he calls them, have compounded the predicament we are in now—namely maturity mismatches, currency mismatches, and capital structure mismatches—all exacerbate the risk of insolvency. India due to its wise and prudent financial management at the Union level, doesn’t figure in the list of countries he calls out as potentially risky.

Where I and many others would take a different view is on his extremely negative view of the impact artificial intelligence will have on society and on jobs. There are enough and more academic studies showing that whenever there has been a technological invention, be it the replacement of the horse-drawn carriages by the automobile or of streetlamps with electricity, while in the short run there is a destruction and loss of jobs, it is invariably made up by the creation of a lot more newer jobs. The same could be said of the arrival of Web 1 and Web 2 of the Internet also. Thus, Roubini paints an extremely dark picture of the technological disruption of employment that appears to be grimmer than what it is likely to be. If history is any judge, then technology has always been beneficial to human progress even though it might take away jobs in the short run.

Roubini correctly predicted the housing crisis and the crash in 2008 and at that time people mocked him. Now they view him as a seer and take his words seriously. Let’s just hope for the sake of the world that the mega obituary that Roubini is predicting turns out to be wrong. For the sake of humanity.

Srivatsa Krishna is an IAS officer. Views are personal