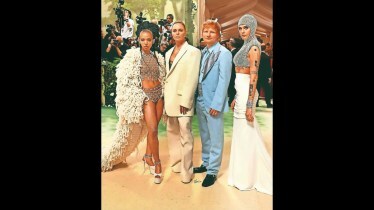

At the New York Met Gala in May, fashion designer Stella McCartney stole the show with an outfit that industry observers described as ‘the most sustainable look’ on this year’s edition of the world’s most prestigious and glamorous fashion event. McCartney took to the red carpet along with her guests, Ed Sheeran and Cherry Seaborn, and model-actress Cara Delevingne, who wore 500 carats of diamonds grown in the zero-emissions foundry of jewellery brand Vrai.

McCartney might have just given her stamp of approval by launching the new collaboration with Vrai, but lab-grown diamonds (LGD)—also known as synthetic or man-made diamonds—have been gaining prominence as sustainable and ethical alternatives to the traditionally mined ones. With sustainability as a buzzword in the global gems and jewellery market, LGDs are somewhat leading a ‘sparkling revolution’, and brands—both in India and abroad—are embracing the jewels that have the same shine, look and feel of natural diamonds, but just a lot cheaper.

Global luxury brand Pandora is endorsing 100% lab-grown diamonds in its collection; so are London-based Bleue Burnham and SkyDiamond, which have collaborated for a dreamy collection available exclusively at the experimental online space Gucci Vault.

Similarly, Luxury Breitling’s Origins Label watches and Jean Dousset luxury jewellery collection have lab-made jewels. Last year, Prada created a collection, Eternal Gold, made from certified recycled gold and LGDs. LVMH, the owner of diamond jeweller Tiffany & Co, also has watches and jewellery featuring LGDs. The brand is also testing luxury buyers’ interest in using man-made stones.

Indian brands, too, are jumping on the bandwagon—DiAi Designs, Solitario, JewelBox and Blue Nile are making waves with their new festive collections showcasing LGDs.

In fact, India is leading the way in LGD production with over 3 million units a year, accounting for 15% of the global output. As per CareEdge Advisory, a knowledge-based analytical group, India is the second-largest producer of LGDs, trailing just behind China. Other than China and India, countries like the US, Singapore and Russia are also manufacturing LGDs in significant numbers.

Shine bright like a diamond

LGDs have lately been in the news for witnessing a significant fall in their prices, besides production overcapacity. A recent report by the Global Trade Research Initiative (GTRI) suggests the segment has seen a steep 65% decline in prices over the past year, from Rs 60,000 to Rs 20,000 per carat.

Experts, however, say this is temporary. As per CareEdge Advisory, LGD exports are expected to witness a revival with growth of 7-9% to reach ~$1500-1530 million in FY25. This is attributed to its price point, environmental sustainability, and intensified competition from India against other leading LGD-producing nations.

Last year, FM Nirmala Sitharaman announced a reduction in basic customs duty on seeds used to manufacture LGD from 5% to nil. This move was made to focus on the LGD exports from India among depleting natural diamond reserves. LGDs with qualified certification, produced from the developed equipment and process parameters, will attract foreign consumers.

Affordability and environmental sustainability are primary factors expected to revive the demand for LGDs, particularly in the 1-3 carat segment of natural diamonds. LGDs have nearly identical chemical, optical, and physical properties and a crystal structure as that of natural diamonds, but at a fraction of their cost.

Instead of mining from the earth and further emptying natural resources, LGDs are created by mimicking the conditions to make them naturally with all four Cs (colour, cut, clarity and carat). The only difference is in its point of origin. Mined ones are formed inside the earth’s surface, while LGDs are created in the laboratory.

The choice between natural and LGDs hinges on budget and personal preference. Natural diamonds offer authenticity, inherent value, and timeless sentimentality, making them ideal for significant occasions like engagements and weddings. In contrast, LGDs are seen as more disposable fashion items due to their lower cost and lack of historical significance. “LGDs are chemically, optically and physically the same,” shares Disha Shah, founder of fine jewellery brand DiAi Designs.

“Lab-grown ones are made under a controlled environment, hence it is possible for them to have minimum inclusions. LGDs, just like natural ones, come in various colours and clarities,” adds Shah.

Varied and fancy shapes are possible in LGDs as it is the ‘rock’ which is grown in the lab, the process of cutting and polishing the diamond after is exactly the same as natural diamonds, hence, the possibilities are endless. The distinctive design aesthetic diverges from traditional offerings in the Indian market. “Our designs are inspired from global luxury brands such as Bulgari, Tiffany, and Harry Winston. We create bespoke sophistication and elegance with a touch of Western influence,” says Ricky Vasandani, CEO of Solitario Diamonds that crafts its diamonds in its state-of-the-art factory located in Surat, Gujarat.

Growing awareness

As per Vasandani of Solitario Diamonds, public awareness regarding LGDs is increasing. “Access to diamonds, once a luxury reserved for few, is becoming more widespread as LGDS offer cost-effective alternatives. LGDs are indistinguishable from their mined diamonds, both in quality and appearance. They are considered natural as they are cultivated from natural diamond seeds. This shift towards LGDs signifies an evolution in the diamond industry, making this gemstone accessible to a broader audience,” says Vasandani, who feels the industry is growing at a pace of 20% YOY, and attributes the surge in demand from metropolitans, where millennials are leading the change, and have done their research on ethical choices in luxury goods.

Shah started DiAi Designs in 2018 and has seen a drastic rise in demand. “Both Indian and international buyers in the age group of 30-45 years are interested in the product. The demand is much higher in the West and we see India following in their footsteps. We don’t believe that the demand for LGDs has surpassed the natural diamonds yet, however, an additional market has opened up for us which will rise exponentially,” adds Shah, who has seen 200% growth in sales in the past year.

As per David Kellie, CEO, Natural Diamond Council, “LGDs are a mass-produced technological product, easy to replicate in a matter of weeks. They will find their place in the world of fast fashion and costume jewellery, which is why they are a great fit for brands like Pandora and Swarovski.”

Tracing the growing trend, Kellie feels US was the early adopter of LGDs and there was a rapid acceptance in the bridal segment consequently. “The winds have shifted today as the total value of monthly LGD sales in the US decreased by 3.3% in January 2024 compared to the same time last year, as shared by diamond industry analyst, Edahn Golan, and this is due to the constant drop in prices. Signet, the world’s largest retailer, has stated that the consumer dissonance generated by falling LGD prices could negatively impact their reputation. Analyst Paul Ziminisky expects the price of LGDs to settle at $100 a carat. All these trends signify that LGDs have their legitimate place in the world of fashion jewellery, and that is where we expect them to settle globally,” says Kellie, who feels LGDs aren’t sustainable as a majority of them are manufactured in India and China through coal-led grid electricity and require temperatures up to 20% of the sun’s surface.

Even as consumer demand is influenced by several key factors like price, specific or occasional needs, and budget constraints, over the past two years, the price gap between natural and LGDs has significantly widened. As per entrepreneur Shreyans Dholakia, brand custodian of diamond enterprise Shree Ramkrishna Exports, “Lab-grown alternatives are now priced at approximately 10% of the cost of natural diamonds. Supply dynamics further differentiate the two products. Natural diamonds are limited in supply due to decreasing mine production, leading to anticipated price increases in the future. Conversely, LGDs are mass-produced through technology, leading to a rise in supply and a subsequent decrease in value over time.”