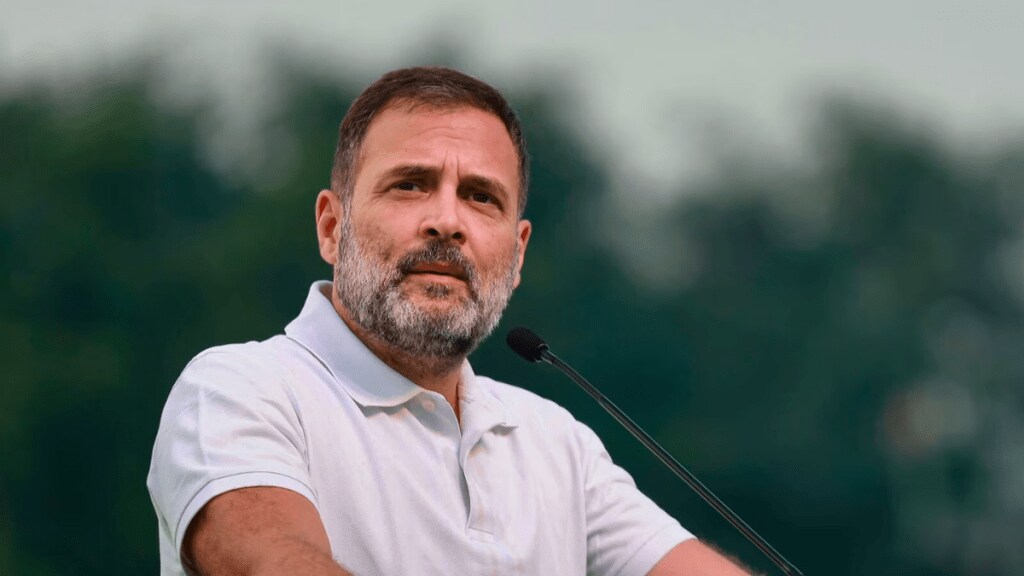

Congress leader Rahul Gandhi on Tuesday criticised the Life Insurance Corporation of India (LIC) for investing Rs 5,000 crore in the Adani Group, alleging that public money is being used to benefit private entities.

In a sharp post on social media platform X (formerly Twitter), Gandhi said, “Money, policy, premium are yours; Security, convenience, benefit for Adani!” — underscoring his long-standing allegations of crony capitalism.

The remarks come in response to Adani Ports and Special Economic Zone Ltd (APSEZ) announcing that it had successfully raised Rs 5,000 crore through its largest-ever domestic bond issuance. The funds were secured via a 15-year Non-Convertible Debenture (NCD), entirely subscribed by LIC.

According to a company statement, the NCDs were issued at a competitive coupon rate of 7.75% per annum and will be listed on the Bombay Stock Exchange (BSE). APSEZ highlighted that the debenture issuance was backed by its strong financials and a domestic ‘AAA/Stable’ credit rating.

LIC, a government-run financial institution and one of India’s largest institutional investors, collects funds primarily through insurance premiums paid by the public. Gandhi and other opposition leaders have repeatedly raised concerns over LIC’s significant exposure to the Adani Group, arguing that it puts common citizens’ savings at risk.

The Congress MP’s remarks reignite the political debate surrounding the relationship between large corporate houses and public sector financial institutions. Gandhi has made the issue a cornerstone of his party’s economic narrative, especially in the wake of past allegations against the Adani Group regarding overvaluation and transparency.

While APSEZ emphasized the investment was market-driven and based on sound financials, the political spotlight on public sector investments in private conglomerates is likely to intensify further.