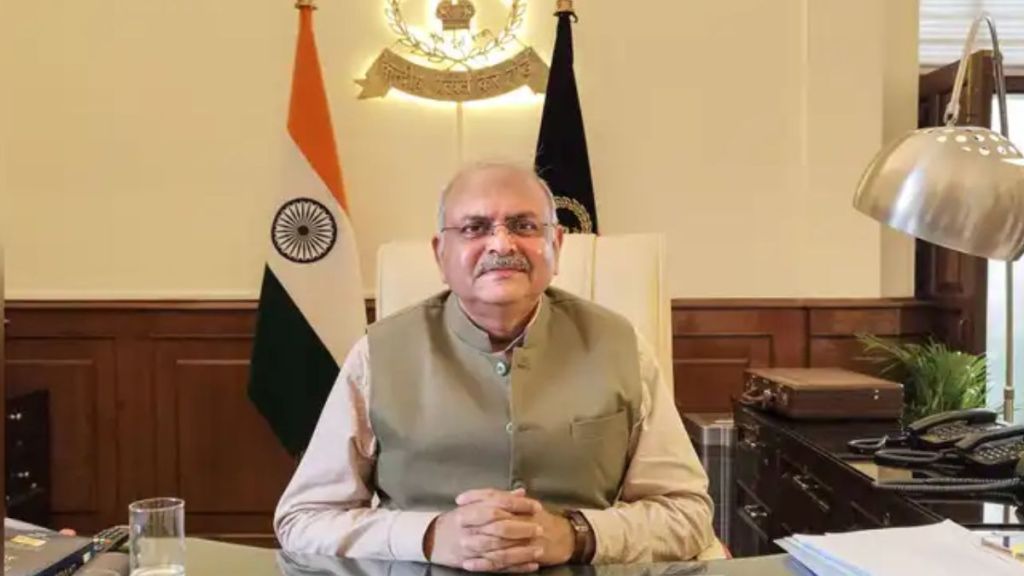

Despite a moderation in direct tax collections so far in the current financial year, the Central Board of Direct Taxes (CBDT) chairman Ravi Agarwal is hopeful that the target of Rs 25.2 lakh crore for FY26 will be met. He told Prasanta Sahu that tax scrutiny cases are picked up through a fully automated and identity-blind process without human intervention. Edited excerpts.

There is a moderation in tax collections so far in FY26. How are you going to meet the budget estimate?

When the net tax collection target was set, this element (personal income tax cut) was also factored in. The moderation in collections being witnessed now is primarily attributable to higher refunds outgo. Since the due date for filing returns has been shifted to September 15 this year (as against July 31 last year), collections to that extent has taken a hit. But then, going forward, we feel that as the economy grows, so would the tax collections. Better tax administration would also yield results. We are hopeful of meeting the target.

Like in GST, is there a move towards capturing the unregistered persons to expand the direct tax net?

As awareness rises, compliance will go up. So, I would not expect that all these 400 million people whose Annual Information Statement (AIS) is generated are supposed to file the returns, or they ought to be taxpayers. That’s not the case. But, yes, there is a scope for improvement. It’s not that the taxpayer is not aware about it. Once data matures and more information is gathered, and people will become more compliant, especially the younger generation.

How are you addressing the issue of pending disputes?

About 5.5 lakh cases are pending. We have taken several steps. Last year, we disposed of more than 1.75 lakh appeals. The number of disposals was more than the number of new appeals instituted. We have already set for ourselves a target of more than 2 lakh for this year, but then we will not rest at that, and we’ll try to (reduce it) further.

How are cases selected under Computer Aided Scrutiny Selection (CASS)?

The CASS is a technology-driven system used to select tax returns for scrutiny, aiming to ensure efficiency, transparency, and objectivity. Advanced data analytics are extensively used to detect anomalies such as unusually high deductions, excessive expense claims, low profit-to-turnover ratios, large related-party transactions, and discrepancies with third-party data (e.g., TDS, SFT). Once finalized, the approved risk rules are operationalized through a fully automated and identity-blind process, ensuring unbiased and consistent selection across the taxpayer database. Upon selection by CASS, scrutiny notices are generated and issued centrally to maintain integrity and confidentiality.

Just 0.3% of all income tax returns filed annually are selected for scrutiny, including cases chosen under CASS and other mechanisms like reopening. The proportion specifically selected under CASS typically ranges from 0.05% to 0.2% of total annual returns filed. For 2024-25, about 2,50,000 cases were selected for scrutiny, representing only about 0.29% of total ITR filers. The department operates on a “Trust First and Scrutinise Later” philosophy, focusing on high-risk cases rather than random selection.

When do you decide to undertake an intrusive investigation?

The “nudge” approach is our preferred first step for taxpayers where we observe minor discrepancies or potential omissions. The aim is to engage with them and encourage voluntary compliance. The vast majority of taxpayers are honest, and we believe in trusting them.

Intrusive steps are reserved for cases where there is credible intelligence or significant evidence of large-scale tax evasion, concealment of income, or involvement in illicit activities. Even in these cases, the decisions to invoke intrusive options are not taken lightly and are based on a rigorous internal approval process. Our goal is to create a deterrent effect for willful defaulters while fostering a climate of trust for the honest taxpayer.