If you plan to study in Canada as an international student, you must provide documentation that you will be able to support yourself financially during the course term. In addition to the expense of your tuition, you must show that you have at least $10,000 Canadian dollars in assets before entering the country. A Guaranteed Investment Certificate (GIC) purchased from an authorized Canadian financial institution, such as SBI Canada Bank, is one approach to meet this requirement.

SBI Canada Bank offers a Student GIC Program to students from India who intend to study in any Canadian province other than Quebec. You can complete the requirements of your student visa application by purchasing a GIC from SBI Canada Bank 10,000 Canadian dollar (CAD ) through the SBI Canada Bank Student GIC Program.

A GIC is a type of investment account with a fixed duration and a guaranteed interest rate. Before you may take your money from the GIC, you have to keep it there for a predetermined amount of time. Your funds will accrue a guaranteed interest rate throughout that time.

SBI Canada Bank is a CDIC member and deposit insurance is available through the Canada Deposit Insurance Corporation (CDIC) for Student GICs.

The process to invest in Guaranteed Investment Certificate

One needs to transfer CAD 10,000 plus fees to SBI Canada Bank after opening an account with them.

The bank will open two accounts in your name after successful verification and account activation:

A Super Saver or Chequing Account: Bank will credit this account with CAD 2,000.

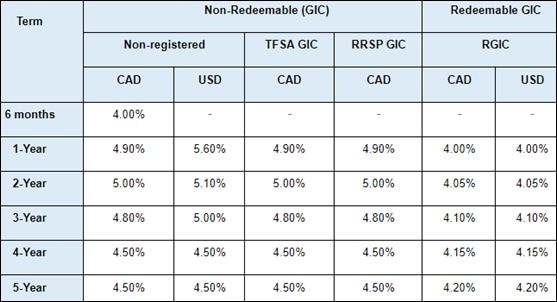

A Non-Redeemable Student GIC account: The remaining CAD 8,000 will be invested in a one-year non-redeemable and non-renewable GIC account.

Interest will be paid on the funds in your GIC account. For the next 12 months, an equal monthly payment of principal and interest will be sent from your GIC account to your savings or checking account.