Alphabet Inc. (NASDAQ: GOOG, GOOGL) announced financial results for the quarter ended June 30, 2024. However, Google-parent Alphabet stock price could be under pressure despite topping earnings and revenue estimates, as Youtube advertising revenue missed forecasts.

On July 23, 2024, Alphabet also announced a cash dividend of $0.20 per share that will be paid on September 16, 2024, to stockholders of record as of September 9, 2024, on each of the company’s Class A, Class B, and Class C shares.

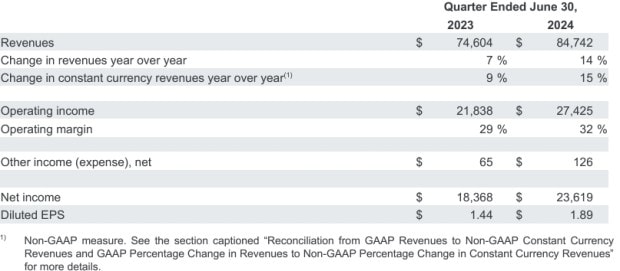

Ruth Porat, President and Chief Investment Officer; CFO said: “We delivered revenues of $85 billion, up 14% year on-year driven by Search as well as Cloud, which for the first time exceeded $10 billion in quarterly revenues and $1 billion in operating profit. As we invest to support our highest growth opportunities, we remain committed to creating investment capacity with our ongoing work to durably re-engineer our cost base.”

Q2 2024 Financial Highlights (unaudited)

Alphabet report segment results as Google Services, Google Cloud, and Other Bets:

Google Services includes products and services such as ads, Android, Chrome, devices, Google Maps, Google Play, Search, and YouTube. Google Services generates revenues primarily from advertising; fees received for consumer subscription-based products such as YouTube TV, YouTube Music and Premium, and NFL Sunday Ticket, as well as Google One; the sale of apps and in-app purchases and devices.

Google Cloud includes infrastructure and platform services, collaboration tools, and other services for enterprise customers. Google Cloud generates revenues primarily from consumption-based fees and subscriptions received for Google Cloud Platform services, Google Workspace communication and collaboration tools, and other enterprise services.

Other Bets is a combination of multiple operating segments that are not individually material. Revenues from Other Bets are generated primarily from the sale of healthcare-related services and internet services.

Antonio Ernesto Di Giacomo – Market Analyst Latam at xs.com shares his view on Alphabet’s Financial Results.

Alphabet, the parent company of Google, has reported financial results that have exceeded market expectations for the second quarter of 2024. This achievement has been driven by significant growth in digital advertising sales and a growing demand for cloud services. Advertising sales, which continue to be the company’s primary source of revenue, have experienced an 11% increase, reaching the impressive figure of $64.6 billion. This growth is mainly due to global events and a sustained recovery in business spending. Additionally, Alphabet’s cloud computing division has shown a remarkable increase of 28.8%, consolidating its position in the competitive technology market.

Despite these positive financial results, Alphabet has faced high capital expenditures, reaching $13 billion in the quarter. According to Ruth Porat, the company’s Chief Financial Officer, these expenses will remain elevated for the rest of the year. This financial reality has had a mixed effect on the stock market, where Alphabet’s shares initially rose by 2% but later experienced a decline. The market volatility reflects the uncertainties about how the company will manage these high spending levels while continuing to invest in its future growth.

Artificial intelligence (AI) is one of the areas in which Alphabet is placing considerable focus. Despite facing challenges with some AI products, the company remains committed to improving its offerings. Alphabet has been exploring strategic acquisitions to strengthen its AI portfolio, considering companies like Wiz and HubSpot. However, both acquisitions were canceled, highlighting the complexity of navigating the tech mergers and acquisitions landscape.

In advertising, Google has made the controversial decision to retain third-party cookies in its Chrome browser, a move that responds to advertisers’ concerns. This decision is crucial since advertising remains the central pillar of Alphabet’s revenue. Maintaining advertisers’ trust is essential for the company’s financial stability, especially in a constantly evolving digital environment where user privacy and government regulations influence market strategies.

Finally, Alphabet’s other bets, which include innovative projects like Waymo, its autonomous vehicle unit, have also shown significant progress. Waymo’s revenue increased by 28%, demonstrating the potential of these initiatives outside the company’s traditional businesses. Furthermore, Alphabet plans an additional $5 billion investment in Waymo, signaling its commitment to developing cutting-edge technologies and its long-term vision of a future dominated by autonomous vehicles.

In conclusion, the second quarter of 2024 has been a period of outstanding achievements and challenges for Alphabet. The company has demonstrated its ability to capitalize on growth opportunities in digital advertising and cloud services while simultaneously facing the need to manage significant expenses and technological challenges. As Alphabet continues to advance in key areas like artificial intelligence and autonomous vehicles, the company’s future will depend on its ability to balance innovation with financial sustainability. With a clear strategy and a focus on expanding its technological ecosystem, Alphabet is well-positioned to remain a leader in the global technology industry.