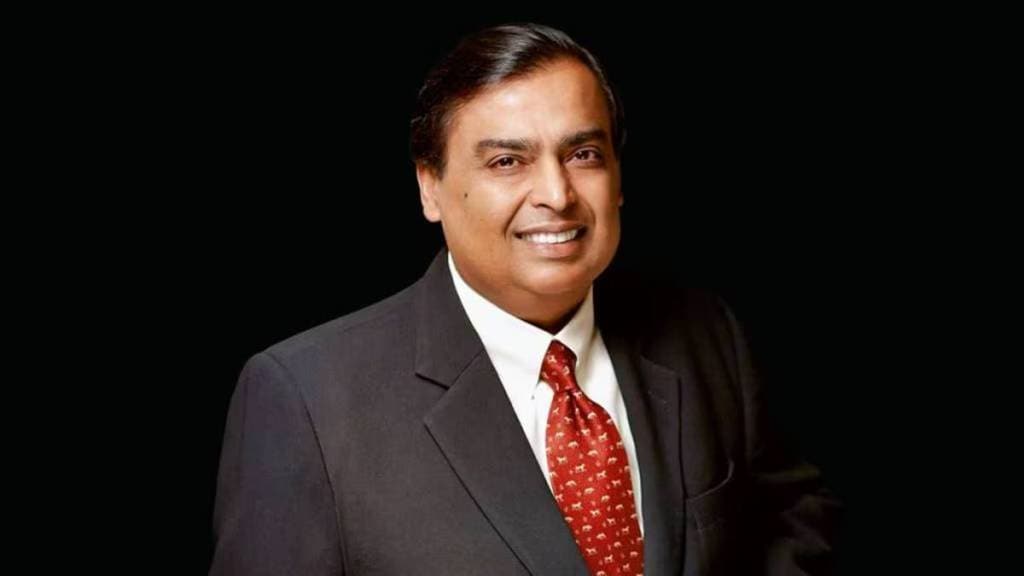

India’s richest man, Mukesh Ambani-owned Reliance Industries, has secured a loan worth $2.98 billion, according to a Bloomberg report. This is largest such deal for an Indian borrower in over a year.

Citing sources who wished not to be named, report further states – around 55 banks have joined a loan agreement. This makes it the largest group of lenders for a syndicated loan in Asia this year so far.

Data compiled by Bloomberg shows that loan amounts in the Asia Pacific region, excluding Japan, have reached a 20-year low in 2025. Only about $29 billion worth of deals in major global currencies (US dollars, euros, and Japanese yen) have been finalised. Therefore, this loan shows lenders’ desire for high-quality investment opportunities in an Asian market where deal activity has been low.

After this Reliance deal, the total loan amount for the year so far is expected to reach $10.4 billion, the fastest rate in at least ten years, Bloomberg data suggests. The report claims, it highlights a trend in foreign currency loans to Indian companies increasing significantly. This surge is largely due to a major loan taken out by Reliance Industries.

Bloomberg states, Reliance Industries’ loan is divided into a $2.5 billion part and a ¥67.7 billion (equivalent to $463 million) part. The agreement for this loan was signed on May 9th.

Before this current loan, Reliance Industries had not borrowed from international markets since 2023. In that year, the company raised over $8 billion through loans, including a $5 billion syndicated deal. Those previous loans, for the parent company and its subsidiary Reliance Jio Infocomm Ltd., also attracted about 55 lenders. Banks were eager to participate in loans to such highly rated companies, according to Bloomberg data.

Reliance Industries’ credit rating is currently one level higher than the Indian government’s rating. This is unusual, as a company’s creditworthiness is typically lower than that of its home country. Moody’s Ratings has rated Reliance Industries as Baa2, and Fitch Ratings has given it a BBB rating.