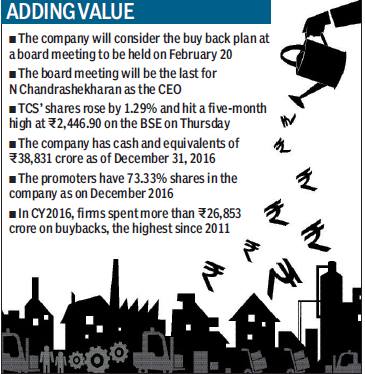

Tata Consultancy Services (TCS), India’s largest IT company, will consider a proposal to buy back its shares at a board meeting to be held on February 20. In a filing to exchanges on Thursday, TCS said, “Pursuant to Regulation 29(1) of Sebi (Listing Obligations and Disclosure requirements) Regulations, 2015, we would like to inform you that the board of directors will consider a proposal for buyback of equity shares of the company at its meeting held on February 20, 2017.”

The board meeting on February 20 will be the last for N Chandrashekharan as the CEO of the company. He is set to take over as the chairman of Tata Sons, which owns TCS.

TCS’ shares rose by 1.29% and hit a five-month high at R2,446.90 on the BSE on Thursday. A total of 22.38 lakh shares of TCS were traded at the counters of the BSE and NSE on Thursday, 1.5 times more than its three-month average of 14.02 lakh shares.

This will be the first time TCS will be buying back its shares if the proposal is approved. The company has cash and equivalents of R38,831 crore as of December 31, 2016. The promoters have 73.33% shares in the company as on December 2016.In CY2016, firms spent more than R26,853 crore on buybacks, the highest since 2011.

According to Sebi rules, a company can buy back shares either from its existing shareholders on a proportionate basis through a tender offer, the open market or odd lot holders.

In the case of a tender offer, the company has to deposit 25% of the consideration in the escrow account if the consideration does not exceed R100 crore.

Companies offer buybacks to enhance their value since the shares bought back are extinguished and the earnings per share (EPS) gets a boost.