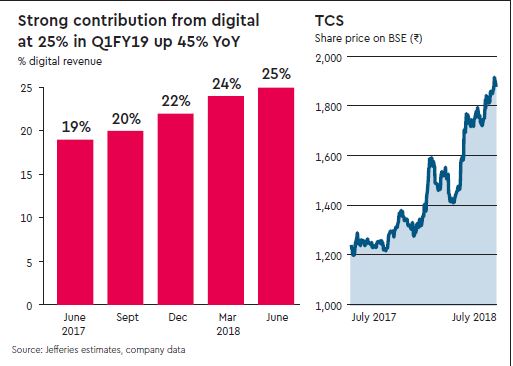

TCS delivered a strong performance in Q1 with q-o-q constant ccy growth of +4.1% and Ebit margin of 25% ahead of our (and consensus) high expectations. Mgmt indicated better outlook for BFSI, with recovery even in North America, and greater visibility on return to overall double-digit y-o-y growth. Weak rupee is an additional tailwind. We raise growth and margin estimates and upgrade stock to Buy noting best growth prospects amongst Tier-1 IT companies.

Beat in constant ccy growth, margin

TCS’ Q1 results were a beat even against elevated expectations as it reported q-o-q constant ccy of +4.1% vs. our estimate of 3.8% and consensus expectation of 3.4%; Ebit margin of 25% also surprised positively against our (and consensus) estimate of 24.6%, as management indicated 70bps of operational efficiency gains q-o-q in addition to 70bps of positive currency impact vs. 180bps of adverse impact from wage hikes. Cross currency headwind of 250bps q-o-q surprised negatively but was offset to a large extent by better INR-USD rate.

Better outlook on BFSI

Importantly, there was an uptick in performance and outlook on BFSI with the company indicating recovery in North America which has been a drag in recent quarters. Management said that the recovery is broad-based across small and large clients.

Better visibility on double-digit growth

On overall basis, mgmt indicated improved outlook on return to double-digit y-o-y growth helped by non-RFP based transformational deals, better visibility in BFSI and continued momentum in Europe/UK. TCS also reiterated its target of 26-28% Ebit margin citing favourable currency and better revenue growth as tailwinds.

Raising estimates

We raise our y-o-y constant ccy growth rates to 10-11.5% over FY19-21e vs. 8.5-10% earlier and factor in weaker INR leading to 4-6% increase in rupee revenue estimates. We also raise Ebit margin on back of weaker rupee and better revenue growth leading to 9-13% increase in Ebit over FY19-21e.

Upgrade to Buy

We raise our price target for TCS to Rs 2,140 (prev. Rs 1,600) based on 22x (19x prev.) 12m forward EPS as of Jul-19 and upgrade the stock to Buy (from Hold). We believe valuation premium to peers is justified by better growth visibility/outlook as it is the only Tier-1 IT company in our coverage with double-digit growth over FY19-21e. High FCF/dividend yield, USD exposure and sector leadership support valuation on an absolute basis.