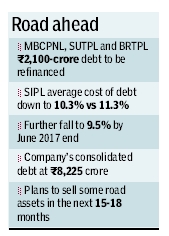

Sadbhav Infrastructure Project, an arm of Sadbhav Engineering, is looking to refinance three more of its operating road projects. The interest cost post the re-financing of R2,100 crore of debt on Maharashtra Border Check Post Network Limited (MBCPNL), Shreenathji-Udaipur Tollway (SUTPL) and Bhilwara-Rajsamand Tollway Limited (BRTPL) will come down to around 9-9.1%, resulting in an additional annual saving of R40 crore on interest payment on these three assets.

The company over the last year and a half has refinanced nearly R2,400 crore of debt on five of its operational roads, which included Aurangabad-Jalna (AJTL), Nagpur-Seoni (NSEL), Bijapur-Hungund (BHTPL), Dhule-Palesner (DPTL) and Hyderabad-Yadgiri (HYTPL).

As a result, the average cost of debt for the operational road SPVs came down to 10.3% as on December 31, 2016 — a 100 basis points reduction on a year-on-year basis from around 11.3% during the three months of October-December 2015. This in turn led to a saving of close to R70 crore on interest payment on an annual basis, a senior company official said.

Varun Mehta, chief financial officer, Sadbhav Infrastructure Project told FE that post the completion of re-financing of these three assets, company’s borrowing cost will further come down to about 9.5% by June 2017 end. Mehta said that the company will keep looking at various structures and new markets to reduce the cost of funds. “At construction stage the interest rates are much higher, but once the construction risk is over, there is scope for refinancing at a lower interest rate, which is what we are vying for, and will also help in better valuations,” Mehta said.

In fact, in an analyst call recently, Nitin Patel, director, Sadbhav Infrastructure Project (SIPL) said that the financial benefit of the reduction in borrowing cost is much bigger for the company compared to the revenue loss suffered due to demonetisation. “We are of the view that it (revenue loss) will get offset within the current quarter, so the benefit of reduction in interest rates will give us much more advantage compared to the reduction in traffic seen in the previous quarter,” Patel said.

Shreenathji-Udaipur became operational in October 2015 and Bhilwara-Rajsamand in April 2016.

Mehta also said that the company’s intention remains to churn its road portfolio, but it is in no hurry. “We are hopeful that with this financial re-engineering and a pick up in traffic, the assets will fetch better valuations in few quarters from now. Also, we would like to undertake first major maintenance, which typically happens in the 5th-6th year of operations, which will further improve the credit profile of the projects,” he added.

While he refused to give any details about the assets that may change hands or the valuation expectation, Mehta said that there could be some projects sold in the next 15-18 months, in order to raise capital for company’s growth.

Sadbhav Infrastructure Project’s consolidated net loss narrowed to R66.35 crore for the quarter ended December 31, 2016. The total income from operations stood at R322 crore. Meanwhile, company’s consolidated debt stands at around R8,225 crore.