Reliance Jio has reduced upfront cost for JioPhone to Rs 699 (no exchange) vs Rs 1,095 (+phone exchange) previously. Recharges are unchanged. The offer is aimed at increasing JioPhone adds from the current c3mn monthly run-rate and highlights the company’s focus on subscribers. With Reliance Jio becoming the largest operator, price hike is a possibility. But given Jio’s ambition and other investments though, we believe sustainable price increases will occur only once the company crosses 40% market share.

JioPhone upfront cost reduced

Under Jio’s festive season offer, the upfront outgo for subscribers is 30%+ below current offer and no phone exchange is required. It is offering JioPhone for an upfront Rs 699 only vs the earlier offers of 1) Rs 1,500 with no exchange and 2) Rs 1,095 with exchange. The company will also provide Rs 99 of additional data for the first 7 months. The offer is valid for the festive Dusheera-Diwali (Oct-Nov) season.

Sub adds the focus

The current offer is aimed at increasing subs addition during the festive season. Jio subs adds have been stable at c8 mn monthly for the past 5 months while JioPhone adds appears to be at c3 mn monthly. The total JioPhone base now is c70 mn, still below its target of 100 mn. We view this offer as a move to achieve the same. It is also likely to shift low end voice only subs to Jio.

Pricing

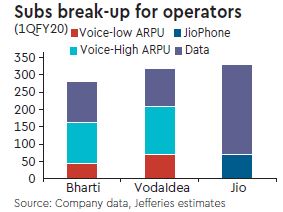

With Jio becoming the largest player by revenue market share, the market dynamics do allow for a price hike and we do build in a price hike in FY21 (15% price hike). Jio’s target of 500 mn and its investment in media and other adjunct areas, though, imply it aims to become a dominant No. 1 player. We thus expect sustainable price hikes to occur only once it crosses 40% market share, which we expect in FY21. We expect VodaIdea market share to fall to c20% and Bharti to remain steady at c30% by FY22.

Remain cautious

We expect market share for VodaIdea to see further decline. We retain our Underperform rating on VodaIdea given its weak network and balance sheet. We expect competitive intensity to remain high for postpaid/enterprise/home segment going forward. While Bharti is better placed, near-term challenges remain for earnings especially in the Enterprise/DTH/Home segment and we retain Underperform.