JSW Steel’s (JSTL) Q1FY18 cons. Ebitda declined 17% q-o-q to Rs 26.2 bn due to seasonal decline in volumes and lower steel prices. Standalone Ebitda at Rs 22 bn was in-line, while the positive surprise came from subsidiaries. S/A sales increased 5% y-o-y to 3.51 mt. Consolidated sales were lower at 3.39 mt due to an increase in inventories at subsidiary level. The share of exports declined 13 pp q-o-q to 23%. S/A Ebitda/t was down 17% q-o-q at Rs 6,262 on lower steel prices, increase in iron ore cost and only $418/t benefit in coking coal cost.

Subsidiaries reported Ebitda of Rs 4.2 bn v/s estimate of Rs 1.7 bn. JSW Coated benefited from conversion arrangement with Uttam. Conversion volumes will inch up further and drive Ebitda. US Plate mill has turned around, with CU increasing 9 pp q-o-q to 28%, which contributed Rs 5.1m to Ebitda. Other subsidiaries (Salav, Industrial gases, etc.) posted strong Ebitda of Rs 1.8 bn. We believe that at least 30-40% of this is sustainable.

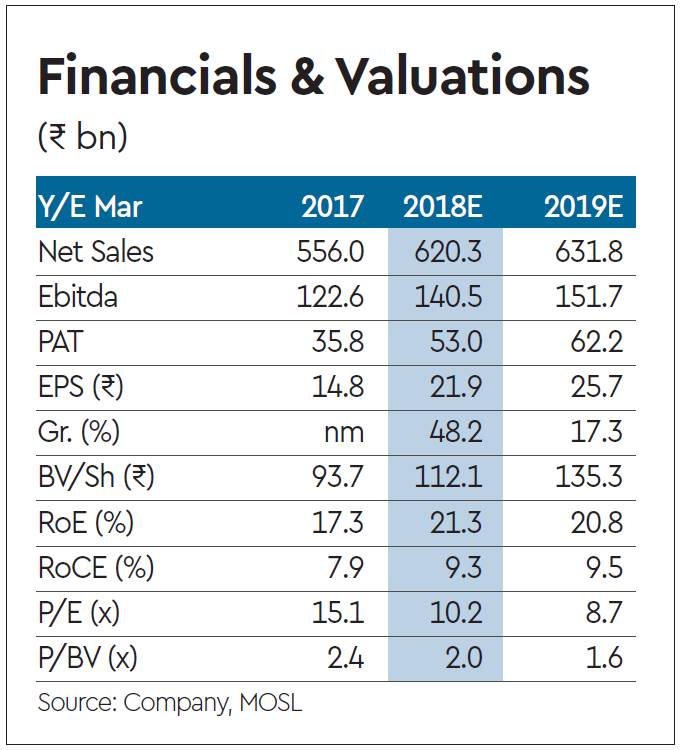

Margin outlook positive; subsidiaries driving upgrade: Global steel market and prices are trading strong, driven by positive surprise in demand from China. Indian steel demand too is inching up. We expect margins to expand for JSTL on declining input cost and stronger steel prices. We are upgrading cons. FY19e Ebitda by 4% to Rs 152 bn on significant improvement in the operating performance of subsidiaries. The SOTP too is increased by 5% to Rs 297/share. Maintain Buy.