STR reported muted Q4 (EPS -50% vs JEFe) weighed down by weak US and Institutional business. Mgmt expects impact to continue in 1H but recovery from 2H. Given its leadership in Australia, steady ramp-up in developed markets and lower CHC (consumer health connections) spend along with expected recovery in US, we expect 35% Ebitda CAGR over FY19-20. Stock trading at 13x FY18e EV/Ebitda, does not factor in any recovery, and risk-reward is favourable. Retain Buy with new Rs 600 TP.

STR reported muted Q4 (EPS -50% vs JEFe) weighed down by weak US and Institutional business. Mgmt expects impact to continue in 1H but recovery from 2H. Given its leadership in Australia, steady ramp-up in developed markets and lower CHC (consumer health connections) spend along with expected recovery in US, we expect 35% Ebitda CAGR over FY19-20. Stock trading at 13x FY18e EV/Ebitda, does not factor in any recovery, and risk-reward is favourable. Retain Buy with new Rs 600 TP.

Subdued Q4: STR reported muted Q4 with adj. EPS of Rs 1.9/sh (JEFe: 4.2). Revenues were 17% and margins 300bps below JEFe. US revenues were down 50% q-o-q ($21 mn vs $42 mn).

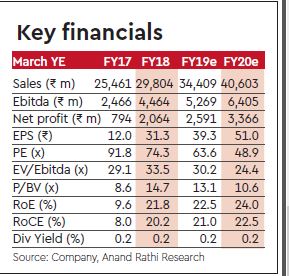

Estimates:We adjust our model for the demerger/sale of API and India business and factor in the new outlook. Consequently our FY19-20 EPS falls by 60/48%. We cut our organic revenue estimates by 10% and margins by 300/180bps.

Valuations factoring in worst case: STR stock price has corrected 50%+YTD and now trades at 9x FY20PE, at 50% discount to sector. Trading at 13x FY18 EV/Ebitda it values the ex-Australia business at 1x EV/Sales implying no recovery. However, we expect better growth. We value STR at 14x FY20e PE, at 25% discount to peers.