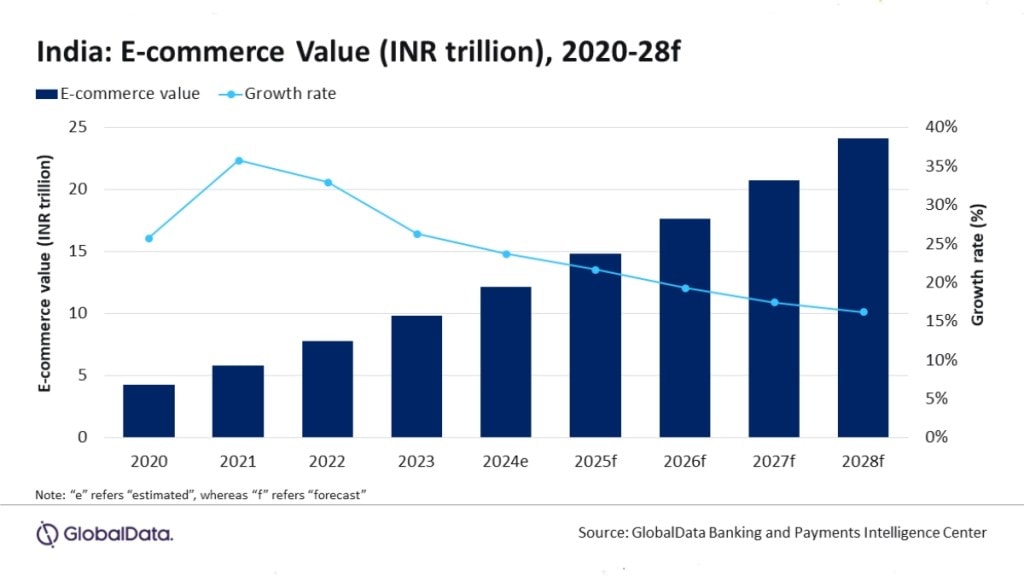

Based on GlobalData’s 2023 Financial Services Consumer Survey, the Indian e-commerce market is projected to grow 23.8% in 2024, driven by increasing consumer preference for online shopping and robust internet penetration. The market value is expected to rise from Rs 12.2 trillion ($147.3 billion) in 2024 to Rs. 24.1 trillion ($292.3 billion) by 2028, reflecting a compound annual growth rate (CAGR) of 18.7%.

Ravi Sharma, Lead Banking and Payments Analyst at GlobalData, comments: “India’s e-commerce market is growing at a healthy pace, supported by rising internet and smartphone penetration and growing consumer preference for online shopping.”

As of March 2024, India’s internet subscriber base has grown to 954 million from 881 million, boosting e-commerce opportunities for merchants, particularly SMEs. E-commerce giants like Flipkart, Amazon, and Myntra attract customers with enticing offers such as discounts and cashback during their major sales events, including Big Billion Days, Amazon Great Indian Sale, and Myntra Big Fashion Festival Sale. This has driven a significant shift in payment preferences, with alternative payment methods, including mobile and digital wallets, dominating the Indian market. In 2023, these alternative payment solutions captured a remarkable 58% of the market share, as reported by GlobalData’s 2023 Financial Services Consumer Survey, highlighting a major transformation in consumer payment behavior.

Sharma adds: “Alternative payment solutions have consistently gained popularity among Indian consumers in the last five years, with some of the popular brands being Amazon Pay, and Google Pay.”

In India, payment cards are the second most popular e-commerce payment method, holding a 25.7% market share in 2023, with credit and charge cards preferred. Meanwhile, cash usage for online purchases has dwindled to just 6.2%. The adoption of electronic payment methods for pay-on-delivery orders, such as Flipkart’s QR code Pay-On-Delivery facility, which supports UPI apps like PhonePe, Google Pay, and MobiKwik, is expected to further boost e-commerce payments.

The future of e-commerce payments in India looks bright, bolstered by government initiatives like “Make in India” and “Startup India,” which have boosted SME growth and online sales. This growth, coupled with a rising number of online shoppers, is driving the expansion of the e-commerce market.

Sharma concludes: “The uptrend in e-commerce sales in India is likely to continue over the next few years, supported by the growing consumer preference, improving payment infrastructure, and growing popularity of alternative payment solutions.”