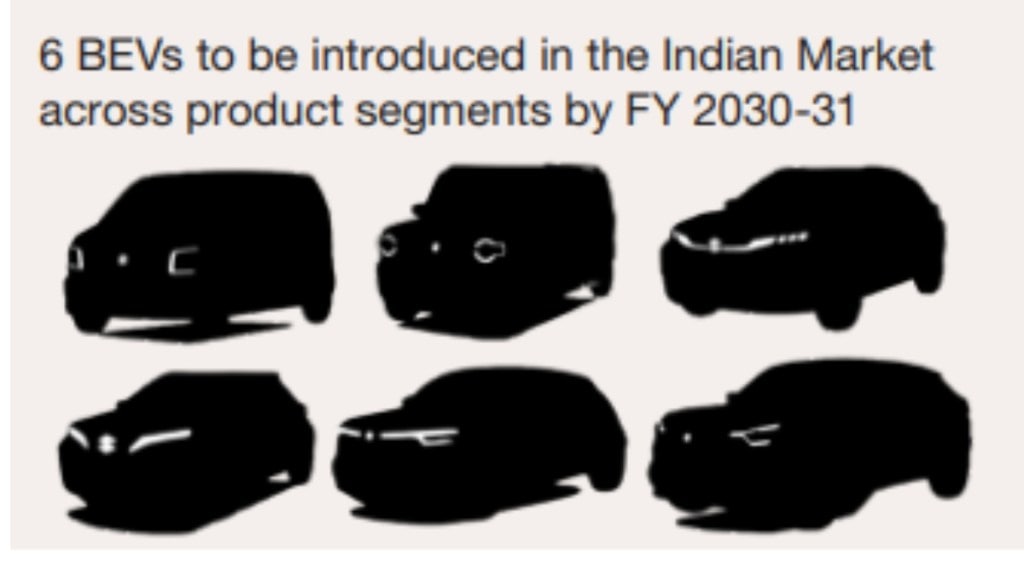

Maruti Suzuki India, the country’s largest carmaker has revealed its future gameplan under ‘Maruti Suzuki 3.0’ strategy. It aims to launch 6 new electric vehicles by FY2031 across segments, and targets 60 percent sales coming from EVs, 25 percent sales from hybrid models and 15 percent from alternate fuel mix such as CNG, biogas, flex fuel, etc.

Furthermore, it aims to categorically expand manufacturing capacity from the existing 2.25 million units to around 4 million units by FY2031. To enable this it has started working its new manufacturing facility in Kharkhoda will become the first plant to be commissioned by the company which will have a manufacturing capacity of around a million vehicles.

It was in December 2022, when the company showcased the WagonR Flex Fuel prototype, which could work ethanol blending range of 20 percent to 85 percent. Maruti Suzuki India will also launch its first flex fuel vehicle by 2025. The carmaker will launch its first EV in FY2024-25.

“A prototype of this EV was showcased in Delhi Motor show held in January 2023. This is a mid-segment SUV with a range of 550km and battery capacity of 60 KWH. The EV will be manufactured in Suzuki Motor Gujarat, for which the production facility is being set-up. For EV battery manufacturing, SMC is setting-up a facility in Gujarat,” said H Takeuchi, MD and CEO, Maruti Suzuki India.

Bullishness on domestic and export leadership

R C Bhargava, Chairman, Maruti Suzuki India in shareholders message said, “Semiconductor shortages still impacted production but to a lesser extent. I expect that during the current year, there will be further improvements, though normalcy in supplies will still not be achieved. We now have four very well-accepted SUVs in the market and are on our way to assume leadership in this segment. We will gradually keep increasing our market share that had declined in the last 2-3 years. Since there are no prospects of demand for the smaller entry-level car market recovering to the growth rates of the past, we are restructuring our production facilities to conform to the realities and what we are projecting for the future.”

“Despite the slowdown in this category hatchbacks and small cars will remain a very important part of our total portfolio. The rate of growth of these cars is expected to be less than 2 percent a year but the industry volume is almost a million cars a year with Maruti Suzuki India having a share of about 70 percent.”

“While we do not expect the car industry to grow in double digits, like what happened in China in the past, we do expect that a 6 percent growth rate will be maintained till FY 2030-31. Along with the rising domestic demand, the prospects for exports are also expected to continue to improve. Our exports rose to 259,000 units last year. We expect the demand for exports to continue to grow and export volumes are projected at 750,000-800,000 cars by FY2030-31.”

“The domestic plus export requirements have made it necessary for Maruti Suzuki to add another 2 million manufacturing capacity. Work is progressing at the first site in Kharkhoda, Haryana, and it is expected that the first plant of 250,000 capacity will start production in the first half of 2025. Thereafter, one similar plant will be added each year to reach a capacity of one million. At the same time, we are in the process of selecting a second site for adding another one million capacity by FY 2030-31.”

Maruti Suzuki India already has one of the widest range of product offerings in the country, ranging from entry-level hatchback to full-sized SUVs. By FY 2030-31, Bhargava says the company could have about 28 different models. “Clearly the organisation and systems for selling such a large variety of cars will require changes from what exists at present.”