The Indian automotive component industry is expected to touch $14 billion (Rs 116,634 crore) by 2028, and interestingly the aftermarket segment has $35 billion (Rs 291,585 crore) opportunity says ACMA, the apex body representing component makers in India.

The insights are part of the Global Automotive Aftermarket Research Report, conducted by ACMA in partnership with leading advisory firm Ernst & Young. The study focussed on 7 product categories namely engine parts, suspension & braking parts, transmission parts, braking parts, rubber components, cooling systems and filters, the size of the Indian automotive aftermarket was $10 billion (Rs 83,310 crore) in 2023 and is expected to grow by close to 1.4 times to an estimated $14 Billion by 2028. Tyres and consumables such as batteries, coolants, lubricants however were not covered in the study.

The growth of aftermarket in India is fuelled by a steady increase in the vehicle parc, which currently stands at 340 million and is expected to grow at a CAGR of over 8% for the next 5-years. The two-wheelers and passenger vehicles parcs are projected to show robust growth from 257 to 365 million units and from around 47 to over 72 million units respectively by 2028. The pre-owned cars sales are projected to grow around 17.5 percent CAGR until FY 2028, fuelled by organised businesses and online platforms. The commercial vehicle parc is expected to grow from 13 million units to 19 million units in 2028. The tractor segment currently contributes close to $1 billion (Rs 8,331 crore) to the Indian aftermarket and the parc is expected to grow from 14 million units to over 19 million units during the 2023-28 period.

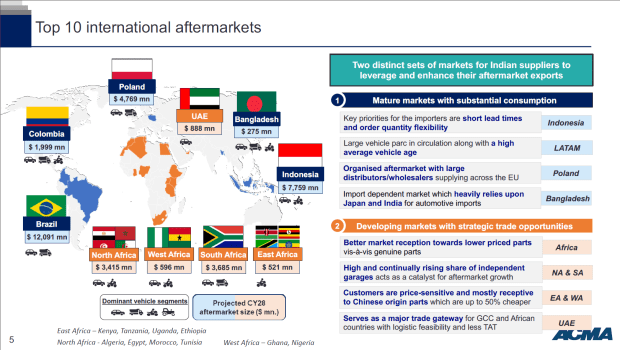

On the international front, the study covered 39 countries and narrowed down its focus on 10 major export markets, identifying over $35 billion worth of export opportunities. Five of these markets namely Indonesia, LATAM, Poland, Brazil, Columbia and Bangladesh have matured aftermarket with a substantial number of ageing vehicles while another five markets, i.e., North Africa, South Africa, East Africa, West Africa and UAE are fast developing and offer high growth opportunities. The combined export potential to these 10 markets is expected to grow to over $35 billion by 2028. Shradha Suri Marwah, President ACMA, Chairperson and MD, Subros said, “The insights from the Global Automotive Aftermarket Research highlight unique opportunities for the Indian auto component aftermarket players. The Indian domestic aftermarket, valued at $10 billion in 2023, is poised to surge almost 1.4 times over the next 5 years on the back of growing vehicle demand and promising capabilities of the Indian aftermarket players. Likewise, key ten international markets offer export opportunities of over $35 billion. The Indian components suppliers need to focus on building partnerships with international buying groups to gain market access, invest in marketing and branding, increase digital presence, and build collaboration amongst the industry players to provide their joint offerings to tap the global market opportunities.”

Vinnie Mehta, Director General, ACMA said, “The Indian auto component makers witnessed a promising 7.5% growth in the first half of FY2024 due to increased demand for pre-owned vehicles, preferential shift towards larger vehicles and the increasing formalization of the repair and maintenance market. On the back of fast-growing aftermarket opportunities, we are thrilled with the response for participation, from both domestic and international players, at the ACMA Automechanika New Delhi 2024. The event gives auto component manufacturers from across the world a platform to connect and demonstrate capabilities in the aftermarket. The exhibition has been seamlessly integrated into Bharat Mobility Global Expo 2024.”

The 5th edition of ACMA Automechanika New Delhi from February 1 to 3,2024, in Bharat Mandapam, Pragati Maidan, New Delhi will witness over 500 exhibitors from more than 12 nations, with dedicated country pavilions from Japan, Germany, Korea, Taiwan and Thailand, showcasing their aftermarket product innovations, technological advancements, and sustainable mobility solutions.

In addition, another close to 100 exhibitors will be participating in two exclusive Auto Components Pavilions showcasing products and solutions for OEMs.