The allure of high returns has always been a major draw for investors, especially in an environment where interest rates seem stagnant. Recently, there’s been a significant buzz in India’s fixed-income market with bonds offering returns as high as 12-14%. It’s hard to ignore the appeal of such attractive yields, particularly when many of these instruments are seen as low-risk.

The temptation is understandable – why settle for a 6-7% return on a government bond when you could pocket 14%? But what’s the real story behind these high yields? Are these high yields really as safe as they seem, or are investors inadvertently overlooking underlying risks that could materialize with serious consequences?

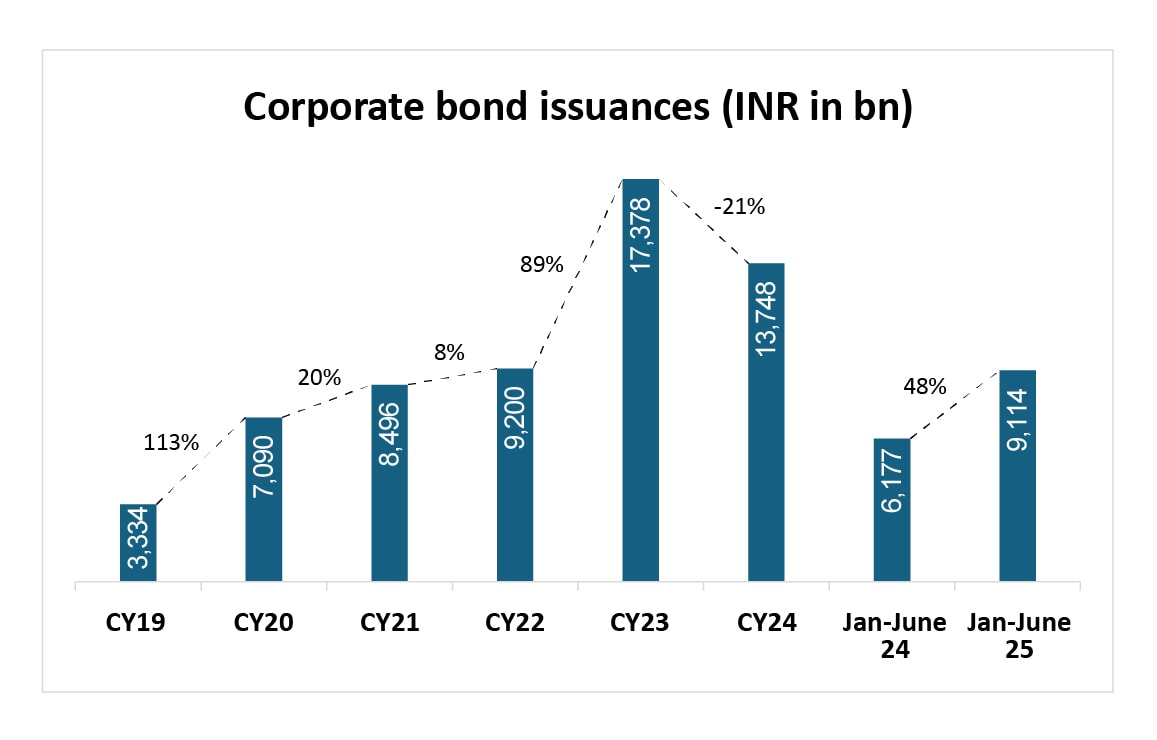

Over the past few years, corporate bond issuances in India have been on the rise. We have seen the issuance peaking in 2023 with an 89% YoY increase to ₹17,378 billion. The jump was likely driven by a combination of factors, including rising interest rates and an improving economic climate post Covid-19. The first half of CY 2025 so far too saw an impressive 48% YoY growth in corporate debt issuances. Companies, especially in sectors like real estate, infrastructure, and non-banking financial companies (NBFCs), have increasingly turned to the bond market to raise funds.

The allure of the 12-14% promise

In the face of low interest rates post rate cuts in 2025 on safer options like bank fixed deposits, these higher-yielding corporate bonds are tempting for investors looking for a higher return. However, many of these high-yield bonds are not as safe as they might appear.

The danger of default (credit risk)

A closer look for FY 24 issuances reveals that nearly 65% are AAA rated (highest credit rating), and nearly 11% are below BBB.

Bonds rated lower than BBB fall into the category of non-investment-grade or “junk” bonds. While these ratings don’t mean immediate default, they do indicate a higher risk of credit issues. A company rated AA is still considered “investment-grade,” but it’s a far cry from the safety of AAA rated bonds, which are generally considered as sound standard for creditworthiness. So, the logic here is simple – The lower the rating, the higher the likelihood that the issuer could face financial troubles. And these troubles can take many forms, from poor cash flow to unforeseen economic conditions or even regulatory changes.

This is where credit ratings become vital. They aren’t just numbers or alphabets – they represent an expert evaluation of a company’s ability to meet its debt obligations. A downgrade can send bond prices plummeting, leaving investors with significant losses. So, when you see a bond offering a 12% yield, you need to ask: why is the return so high? Typically, it’s because the company issuing it carries more risk.

For instance, look at the IL&FS and DHFL cases. Both of these companies were once considered reliable issuers of bonds, with investment-grade ratings (AA+). IL&FS, a major infrastructure player, shocked the market in 2018 when it defaulted on its debt after a series of financial mismanagement issues came to light. Investors were surprised by the company’s collapse, as it had been offering bonds with relatively high yields, which many had viewed as a safe bet.

Similarly, Dewan Housing Finance Limited (DHFL) also faced a major crisis after the IL&FS collapse in 2018, triggering a liquidity crunch due to a mismatch between its short-term borrowings and long-term lending. The company went into default as in 2019 and its financial troubles led to a dramatic downgrade in its ratings and a massive loss of investor confidence.

These cases aren’t isolated. They serve as stark reminders of the risks associated with high-yield bonds. The stark reality is that many of these bonds are issued by companies facing financial challenges. While their yields may appear attractive, the underlying risk of default or downgrade remains a tangible threat that investors must carefully evaluate.

The problem is that many investors, particularly those new to fixed-income markets, are often so focused on the high yield that they forget to account for the credit risk involved. They assume that because the bond is a fixed-income product – and this one it offers a higher return – it must inherently be a superior investment. But the truth is, higher returns almost always come with higher risks. And in the case of these bonds, the risk could mean losing a substantial portion, if not all, of the principal.

This brings us to a critical question that every investor should ask themselves: is it worth chasing those few extra percentage points in returns if it means taking on so much risk?

When comparing high-risk, high-yield bonds to more stable options like AAA rated bonds from Public Sector Undertakings (PSUs), the decision becomes clearer. AAA rated bonds, while offering modest returns (typically in the 6-8% range) are largely backed by the Indian Government. While they may not be as enticing as their high-yield counterparts, they provide a level of safety and stability that significantly reduces long-term risk, making them a simpler and more predictable investment choice.

Understanding the risk-return tradeoff is essential for any investor. While the temptation of a 12% return can be hard to resist, it’s crucial to balance that with the risks of potential defaults or downgrades.

In many cases, the stability and predictability of AAA rated bonds, even with relatively modest returns, tend to be a safer option compared to the higher, riskier yields. Risk doesn’t disappear just because we choose to overlook it.

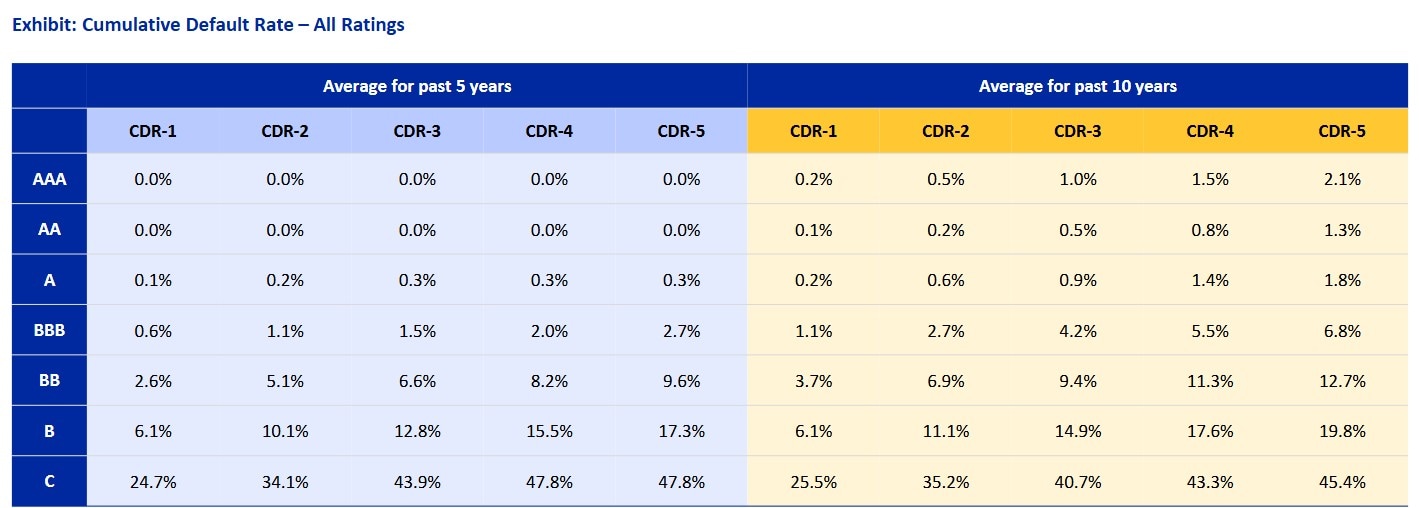

In fact, data from ICRA highlights that even AAA-rated bonds aren’t immune to defaults, as seen with IL&FS in 2019 and DHFL’s securitization defaults in 2020. Bonds rated above BBB, too, have faced similar risks. The key takeaway is that higher returns often come with higher risks that shouldn’t be ignored.

So the truth behind those 12% bonds is simple…

They come with a level of risk that many investors fail to account for. The reality is that while investors may be attracted to the high returns, they often forget the risks that come with them. Whether it’s through the downfall of companies like IL&FS and DHFL or other instances of default and downgrade, the risk is very much real.

So, before you dive into that high-yield bond offering, take a moment to ask yourself: is it really worth the risk? In many cases, opting for safer, lower-yielding options may be a much more reliable choice in the long run.

Sneha Pandey is Fund Manager for Fixed Income and Multi-Asset Allocation Funds at Quantum AMC

Disclaimer, Statutory Details & Risk Factors:

The views expressed here in this article are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments.

Mutual Fund investments are subject to market risks, read all scheme-related documents carefully.