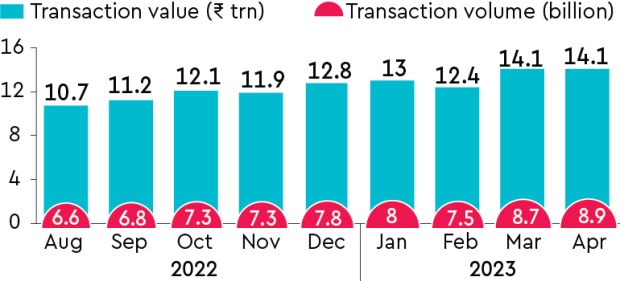

Unified Payments Interface (UPI) transactions rose 43% year-on-year(y-o-y) to a record Rs 14.1 trillion in value terms during April. In terms of volume too, it rose 59% y-o-y to a new high of 8.9 billion.

In March, transactions had hit Rs 14.05 trillion (value) and 8.7 billion (volume) while for February, 7.5 billion transactions worth Rs 12.4 trillion were processed on the platform.

The last three days of April saw nearly 1 billion transactions worth around Rs 1.37 trillion, data from the NPCI showed. This was due to a rise in discretionary spend and planned expenditure as April ended on the weekend, where spends are usually higher, say experts.

“When people start making debit payments, these are linked to two components. First component is money in hand and the second component is expenses and transactions planned. During the weekend, people start spending money,” says Akshay Mehrotra, co-founder and chief executive officer, Fibe.

“On account of being a working Saturday, salaries could be April 29. This meant that money was available to make various payments on Saturday. UPIs are linked to money in the bank account,” he added.

The rise in UPI transactions has been aided by the growth in digital lending, wherein lenders opt to disburse loans through the unified payments interface platform.

Immediate Payment Service (IMPS) transactions rose 5% y-o-y to 486 million in April. In terms of value, it rose 17% y-o-y to Rs 5.2 trillion.

FASTag transactions in April rose 15% y-o-y to 305 million in April. In terms of value, it 22% y-o-y to Rs 5,149 crore.