The most preferred term cover amount for HNIs is Rs 1.75 crore

The most preferred term cover amount for HNIs is Rs 1.75 crore

At present, the interest rate on personal loans is 10.5% to 17% and that of credit cards between 36% to…

These enable investors to navigate the current market uncertainties.

Large-cap stocks tend to be more stable in the long-run, which ensures that the overall portfolio of investors becomes better…

Health insurance policies with international coverage offer emergency treatments, in and outpatient treatment, prescription medications, air ambulance and some elective…

The last two years have seen the consumption sector lagging significantly.

Fund manager’s ability to take smart allocation decisions is crucial

Small prepayments done consistently can reduce the overall interest outgo

These funds offer the advantage of securing higher yields

Allocate 10% of overall portfolio in these funds as alpha-seeking strategy

If you need more time to repay the debt, opt for a personal loan.

Such funds are best for those who want to invest for a very short term

These offer a more stable investment journey for retail investors

As valuations are turning expensive, avoid any lumpsum investments

As per UNCTAD’s nowcast, global trade volume in April-to June rose just 0.2%, led by a contraction in goods trade.

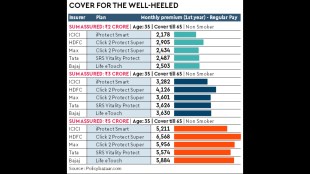

Mortgage insurance is costlier & can’t be ported in case of balance transfer

While the investment objective of an index fund is to replicate the underlying index, it is important to ensure that…

With markets rising, fewer units will have to be redeemed