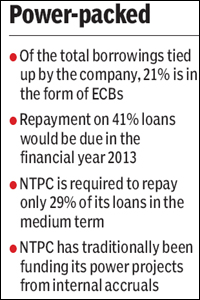

Indian power sector?s largest borrower NTPC has been quite successful in raising long-term funds from the domestic and overseas markets to meet capital expenditure requirement of its ambitious capacity addition programme. Of the company?s total existing borrowings, as much as 33% is of long tenure and would start maturing only in financial year 2017. Of the total borrowings tied up by the company, approximately 21% is in the form of external commercial borrowings (ECBs), the company has told its potential investors.

Repayment on 41% loans would be due in the financial year 2013. NTPC is required to repay only 29% of its loans in the medium term.

What helps NTPC in raising long-term funds at cheaper rates from the overseas markets is that the company?s credit ratings are equivalent to India?s sovereign ratings. Further, the Indian government continues to provide sovereign counter guarantees for loans taken by the company from multilateral lending agencies like World Bank, Asian Development Bank and Japan?s Bank for International Cooperation (JBIC), which provide loans for the power sector at a very attractive rate.

A power utility?s cash flows and profitability critically depend on what is the mix of long and short tenor borrowings in its debt portfolio. Short-term loans mean higher cash outflows on account of interest servicing and principal repayment, denting the company?s bottomlines. That would translate into lower dividend for shareholders.

NTPC has traditionally been funding its power projects from internal accruals. As a result, the company enjoys a relatively gearing ratio of 0.6%, which is rare for a power utility in India. Implies the company has a lot of scope to increase its borrowings and is in a position to aggressively add power generation capacity. This is a key upside in the company?s future growth and profitability.

What gives further strength to the NTPC?s capacity programme is that the company plans to finance its new projects in the debt-to-equity ratio of 7:3, following tariff determination norms set out by the central electricity regulatory commission (CERC). While the company expects to finance equity portion from internal accruals, it would borrow from domestic and overseas markets to fund the debt components.