Page 4 of NRI

One of the most closely watched provisions for the Indian diaspora has been the proposed remittance tax. In its original…

IDFC First Bank’s new feature addresses this gap by enabling NRIs to link their international numbers to their UPI IDs.…

The woman, who worked in a non-tech role she loved back in India and earned a handsome INR 16 lakh…

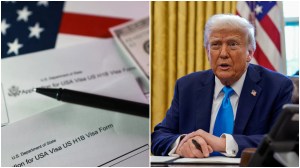

The Senate passed the bill in a razor-thin vote, following intense backroom negotiations and public pressure from president. Trump has…

On corruption, he shares a nuanced view. For smaller bureaucratic tasks, bribes weren’t necessary. But he concedes that “for real…

Following criticism and concerns about the potential impact, the proposal was first lowered to 3.5%. Now, it has been reduced…

To finance this massive immigration expansion, the bill proposes deep cuts to Medicaid, SNAP, and clean energy initiatives, programs that…

“Come home, aajao! Come home and witness modern India, in all of our chaos and infinitely larger beauty, come home,”…

The Delhi High Court ruled in favor of an NRI who faced penalty proceedings for not filing an income tax…

The interview began with the officer requesting his passport and I-20 form. After verifying the documents, the officer asked about…

Despite her achievements, she says she misses India every day and struggles to envision spending the rest of her life…

The proposal envisions starting with a small community, roughly 1 square kilometer (or 250 acres, housing 250 families, designed with…

A particularly detailed and emotional response came from a woman who, alongside her husband, is seriously considering returning to India…

After his employer terminated his green card process and laid off around 300 employees in a company-wide restructuring, the author…

With a net worth of $2 million (approximately ₹16 crore), he believes that is more than enough to sustain him…

For those in their 30s, the post offers advice on prioritising self-care while building a solid financial foundation. The writer…

The proposed policy could massively affect the 2.9 million Indian immigrants currently living in the U.S. (as of 2023), who…

Related News