The popularity and acceptance of leasing a vehicle versus buying a new or used car in India is definitely below global levels, but it’s estimated to grow from a percentage of new car sales to around 2-3 percent in the near term to up to 5 percent in an optimistic note believes Turra Mohammed, SVP & Head, Quiklyz a leasing and subscription arm of Mahindra Finance.

In a recent interaction with Financial Express Online, Mohammed outlined that while the option of vehicle leasing has been around for several years in India, “I believe the leasing industry in India has been around for approximately 20-30 years. However, over the past 4-years, it has gained significant attention, with increased coverage in the media and growing interest from OEMs. This surge in interest has fuelled our decision to enter this business in 2021 under the Mahindra Group, specifically within Mahindra Finance.

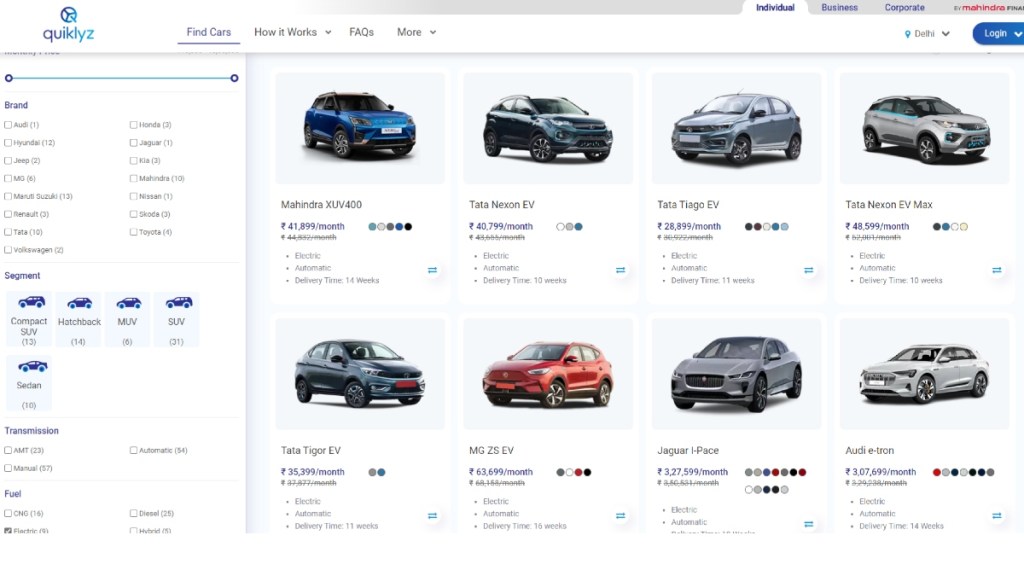

For the unversed, vehicle leasing allows a user to drive a car of his/her choice for a limited period of time in return for fixed rentals. While, the leasing company retains the vehicle ownership it also takes care of all vehicle expenses (barring fuel costs) like road tax, maintenance or other recurring costs. This allows the customer to have a personal vehicle without the need to invest/commit to the vehicle for a lifetime.

Key growth drivers

He says there are four key factors that are driving the demand for vehicle leasing in the country. Firstly, the implementation of the Goods and Services Tax (GST) in 2018 streamlined the tax structure by eliminating the complexities of excise duty and Octroi, which removed some hurdles and created a level-playing field. Secondly, changing consumer sentiments, where individuals are no longer stuck to the idea of owning the vehicle for using it.

“Before the Covid-19 pandemic, many were comfortable using services like Ola and Uber, especially in cities like Mumbai, where parking space is scarce. Ownership was no longer seen as a status symbol, as people were more interested in access and utility. This attitude extends beyond cars and applies to items like furniture and more. While the pride of ownership is deeply ingrained in Indian culture, this shift towards a subscription or usage-based model is gaining traction, albeit gradually.”

“The third factor, that I personally believe could be a game-changer for leasing and subscription services is the advent of electric vehicles.” He says that the upfront higher cost, and fast-evolving technologies, are opening up more opportunities for vehicle leasing.

Lastly, is the average holding period of vehicles. Mohammed says that the average vehicle ownership has gone down from around 6-7 years a decade ago to 4-5 years at present.

Changing dynamics

It was in 2021 that Mahindra Finance entered the vehicle leasing and subscription segment under the Quiklyz brand. In a short span of two years, the company has already leased close to 10,000 vehicles including three-, four-wheelers, and even commercial vehicles. The majority of them are four-wheelers, around 1,000 three-wheelers, and a few commercial vehicles.

The company caters to three kinds of customers – institutional which includes institutes and their employees, then comes the commercial fleet customers (cab and cargo) and finally individual customers.

Mohammed believes that in light of the evolving landscape, “leasing and subscription models have become increasingly essential. When you need to change vehicles frequently due to shorter ownership periods, committing to high Equated Monthly Instalments (EMIs) under a traditional loan, along with the hassle of reselling and maintenance, can become burdensome. Therefore, we anticipate that this changing ownership pattern will further fuel the demand for leasing and subscription services.”

At present, individual buyers make up a small portion of vehicle leasing customers, but this is where Quiklyz sees the maximum potential.

In terms of average ticket size, an electric three-wheeler which costs around Rs 3-3.5 lakh the rental comes to around Rs 10,000-15,000 a month. The majority of the demand from customers in the passenger vehicle segment for Quiklyz is in the Rs 15-20 lakh car range. This translates to monthly rentals averaging around Rs 30,000-40,000.

Demand for entry-level cars is quite minimal when it comes to vehicle leasing. Mohammed believes this is due to the fact that “One is the customer who’s taking a lease or subscription is a little bit involved customer, they’re not the entry-level customer. And second, is that the reason they are taking leasing and subscriptions to able to afford a better car. And most of these people are in the 30 to 45 age group. Most likely, this may not be their first vehicle. They may have either had a used vehicle before or a new vehicle that is already upgraded therefore, this is already their second vehicle.”

In fact, in terms of performance, the company has already crossed the Rs 1,000 crore mark in terms of asset management. It is targeting to have around 40,000 electric vehicles on board by 2025.

“It’s very clear that electric is the future for us. Our portfolio already is around 20 percent electric at present (including three-wheelers and buses), which I think is unparalleled. If you look at the penetration of electric vehicles in India even segment-wise it is not 20%.”

Reach and future

One of the key challenges for any new company is to ensure optimal reach and invest in expansion. This is where Quiklyz benefits from Mahindra Finance’s presence.

“The leasing team may be based out of around 50 locations, but because of Mahindra finance, we have around 1,200 branches and are available across almost every nook and corner of this country. Expanding geographical reach is not a problem for us at all,” says Mohammed.

The company has already identified its targets for the short term, which is to focus on enhancing penetration among existing customer base, improving product offerings, and ensuring customer satisfaction.

In the long term, it seems that there will be significant growth in the number of individuals considering leasing as an alternative to traditional ownership. “Additionally, the used car market holds significant promise. As more vehicles re-enter the market as used cars, we anticipate that within the next two to three years, this segment will become increasingly important.”

The idea is also to further increase partnerships with OEMs who have a much higher presence across the country and create awareness around the concept of leasing as an alternative to purchase.