The passenger vehicle segment is expected to grow between 7 percent to 9 percent in FY2024, from the highs of 17.1 percent and 24.8 percent observed in FY2022 and FY2023 respectively says a report by CareEdge ratings.

It attributes the robust growth observed in the last two financial years on the back of pent-up demand following the recovery from the Covid-19 pandemic, as well as the introduction of new products in the market. The industry benefitted from lower interest rates and an increased desire for personal mobility in the wake of the pandemic.

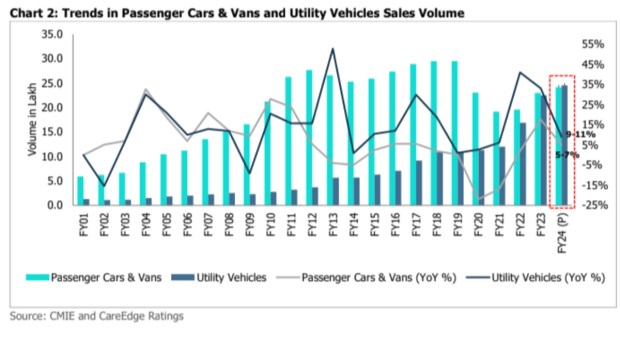

Supply chain challenges, particularly those related to semiconductor availability, were alleviated, resulting in the highest-ever sales volumes for the industry, surpassing the previous peak in FY2019. The growing demand for utility vehicles significantly contributed to the overall volume growth, with utility vehicle volumes increasing by approximately 41 percent in FY2022 and 33.2 percent in FY2023. During Q1 FY2024, PV volumes witnessed a growth of around 2.6 percent compared to the same period the previous year.

The report states that moderation in the PV industry is likely to be seen as the pent-up demand levels off amid a hike in vehicle prices, a high-interest rate environment, and subdued export volume growth on account of a global economic slowdown amid inflationary concerns. Strong order book, improvement in supply chain and semiconductor supplies, robust demand for new model launches and increasing demand in the SUV segment is expected to keep the sales momentum rolling. The demand for premium variants is expected to remain healthy led by increasing demand for the luxury and premium models, while the demand for entry-level variants is expected to continue to remain under pressure due to high-interest rates and an inflationary environment.

Exports to remain tepid

The report states that during FY 2022 and FY 2023, the PV industry reported strong year-on-year export volume growth of around 42.9 percent and 14.7 percent respectively post strong volume de-growth of 38.9% in FY21 on account of covid led disruption. The PV industry continues to report lower export volumes, lower than its peak in FY 2017 on account of the exit of major global automobile manufacturers in the last few years. Despite having a presence in export markets for over three decades Indian PV industry export volumes remain around 15 percent of its total sale volumes which was around 20 percent in FY 2017. The export volumes continue to be driven by global automobile manufacturers. Despite enjoying strong market share in the domestic markets, the domestic PV players’ export volumes remain subdued. SUV volumes command a 45 percent share in the domestic market whereas export volumes are equally distributed among SUVs, sedans and hatchbacks.

Export volumes are heavily dominated by petrol vehicles. Geopolitical issues and macroeconomic headwinds continue to remain a challenge going forward. The export volumes are expected to remain subdued in FY 2024.

SUVs to continue see strong demand

The demand remains strong across both passenger cars and utility vehicles. Passenger cars & vans are expected to report moderate growth of 5-7 percent in FY 2024 due to a strong base effect and other domestic macro environment factors such as high-interest rate scenario, inflation, and rising vehicle prices due to the cost impact of progressive regulatory norms, while utility vehicles are likely to grow by 9-11 percent driven by new model launches and increasing demand for SUVs in the domestic market.

During FY 2022 and FY 2023, utility vehicles reported strong YoY volume growth of around 41 percent and 33.2 percent, respectively, while passenger cars and vans reported growth of around 2.1 percent and 17.6 percent, respectively.

Utility vehicles, which contributed 10-15 percent of total passenger vehicle sales volumes until FY 2012, grew 6.1x between FY 2013 and FY 2023, while passenger cars and vans de-grew by 16.9 percent during the same period as consumer preference shifted towards utility vehicles that offered better and innovative designs, new models, technological, functional and safety features, and customisation.

CareEdge says for the past decade, the utility vehicles segment has consistently outperformed the PV industry growth rate. Currently, UVs account for almost 50 percent of all passenger vehicle sales.

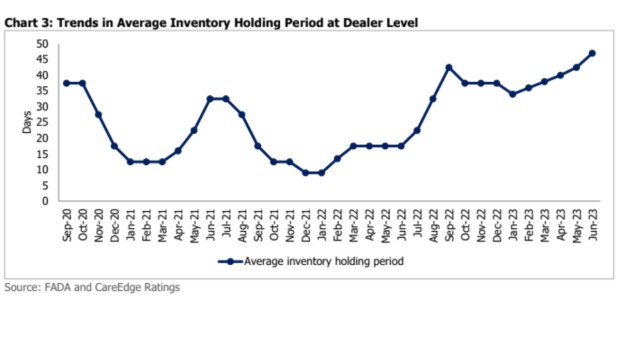

Industry is witnessing a build-up of inventory as seen from the chart below. Average inventory holding with dealers is expected to reduce from the current 45-49 days in the following months due to expected strong sales momentum in the upcoming festive season beginning August 2023.

PV wholesale volume sales grew by 2 percent YoY to 3.27 lakh units in June 2023 while the retail volume grew by 4.79% y-o-y in June 2023 on account of new launches. With an improving penetration rate, electric vehicle volumes in the PV segment is likely to clock volume around 1 lakh for FY2024. Monthly electric car sales have gradually improved in the previous two years from fewer than 1,00 units to around 8,000 units and is expected to continue at similar levels. For June 2023, electric car retail sales have recorded YoY growth of 97 percent with volumes at 7,687 units as against 3,894 units in June 2022.

Outlook

“Strong order book, improvement in supply chain and semiconductor supplies, robust demand for new model launches and rising demand in the sports utility vehicle segment is expected to keep the sales momentum rolling,” said Arti Roy, Associate Director. The demand for premium variants is expected to remain healthy led by increasing demand for the luxury and premium models, while the demand for entry-level variants is expected to continue to remain under pressure owing to high interest rates and an inflationary environment.