The Ministry of Road Transport & Highways (MoRTH) in a draft notification proposed that it will not hike or make changes to the existing third-party insurance premium.

On the contrary, certain vehicle types could benefit from proposed discounts of upto 50 percent on the base premium it says.

For buses registered by educational institutions a discount of 15 percent, private vintage car discount upto 50 percent, while a discount of 15 percent and 7.5 percent for electric vehicles and hybrid vehicles respectively has been proposed. The three-wheeler passenger vehicles could see a discount of upto 6.5 percent on the base premium rate.

The changes are suggested in consultation with the Insurance Regulatory and Development Authority of India (IRDAI).

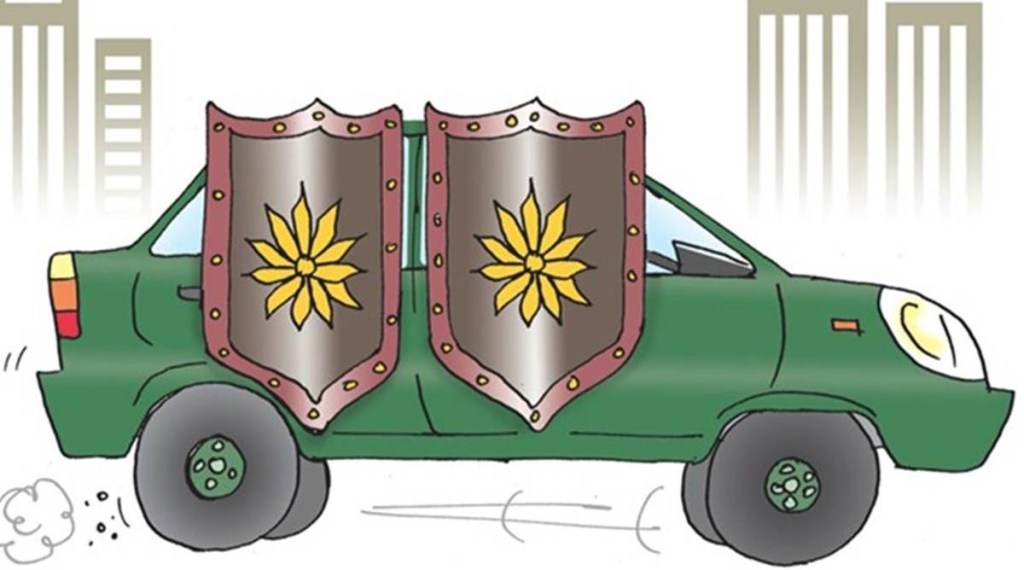

As per The Motor Vehicles Act of India, 1988, every vehicle (private or commercial) registered in the country is mandated to have third-party insurance policy.