The adoption of electric vehicles leading to the requirement for battery manufacturing is estimated to drive demand for 2,400 acres of real estate by 2030 says ‘Electric Vehicles in India – New Wheels on the Roads’ report by CBRE South Asia, a leading real estate consulting firm.

The report focuses on the real estate strategies for various stakeholders in the electric vehicle manufacturing lifecycle. It finds that among 28 states and 8 union territories in India, Uttar Pradesh and Maharashtra are leading manufacturing of the EV charging infrastructure.

It further points out that the current primary clusters for Lithium-ion Battery (LiB) manufacturing exist in Chennai, Hyderabad, Pune, Prantij, Surat, Mandal, Delhi-NCR, Gurgaon, and Mohali. Additionally, Maharashtra has the highest count of sanctioned EV chargers, with 317 under Phase II of the FAME India scheme, followed by Gujarat with 278 EV chargers.

At present, the lithium-ion cells manufactured in India is dependent on raw material imports, which account for 77% of the total manufacturing cost. However, this is set to change with the discovery of a 5.9 million tonne lithium reserve in Jammu and Kashmir’s Reasi District in February this year. This is expected to reduce India’s reliance on imported lithium significantly.

Furthermore, the real estate requirements of manufacturing facilities of two- and four-wheeler is estimated to be around 13 million sqft by 2030 as a result of the government’s EV adoption targets. It is also expected that by 2030, the real estate requirement will allow a production capacity of approximately 4 million four-wheelers and 23 million two-wheelers.

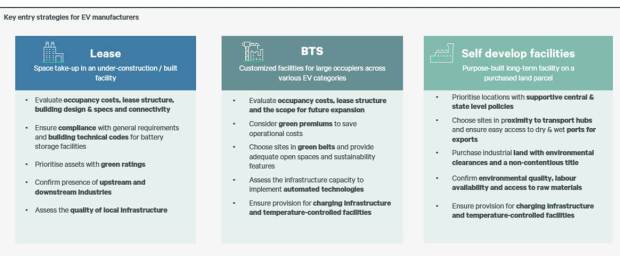

In India, the Built-to-suit (BTS) and leased facilities are primarily preferred by EV manufacturers due to the ease of capital deployment, flexibility in lease terms, speed to market, and location advantages. However, an owned facility provides more scope for customisation, saves monthly rental outgoings, and has better prospects for land price appreciation.

Maharashtra, Tamil Nadu top investments from EV segment

Several policy enablers by the Union and State governments have enabled the creation of an indigenous EV manufacturing ecosystem by incentivising fresh investments from global and domestic players.

The report finds that during 2020-2023 period (YTD), Maharashtra and Tamil Nadu led EV investments with a 15% share each of the cumulative $28.8 billion (Rs 237,513 crore) investment. Meanwhile, Karnataka accounted for an 11% share, Gujarat 8%, and Uttar Pradesh and Telangana recorded a 7% share each.

For the current year, the EV sector has recorded investment announcements of about $6.2 billion (Rs 51,131 crore) to date. The year 2022 witnessed strong traction, with global and domestic players announcing investments of over $17.1 billion (Rs 141,023 crore) in the EV industry, a YoY increase of about 287% compared to $4.4 billion (Rs 36,286 crore) in 2021. In the same period, more than half of the investments were driven by EV component manufacturers.

Interestingly, EV manufacturers and multiple e-mobility start-ups are concentrating their presence in the primary automotive clusters in India. Uttar Pradesh took the lead in registered EV annual sales in 2022 with a 16% share, closely followed by Maharashtra with a 13% share and Karnataka with a 9% share. These three states together dominated India’s EV sales in 2022, accounting for approximately 40% of the overall sales volume.

Anshuman Magazine, Chairman & CEO – India, South-East Asia, Middle East & Africa, CBRE said, “As we look ahead, the intersection of real estate and the EV sector presents exciting opportunities and challenges. The rapid growth in EV manufacturing is set to revolutionise the automotive industry, and it will undoubtedly have a profound impact on the real estate market.”

“By 2030, we anticipate a surge in demand for real estate, with a requirement of around 13 million sqft dedicated to EV manufacturing facilities alone. The cumulative investment value in EVs over the last three years demonstrates the immense financial commitment and confidence placed in this sector. This investment not only signifies the financial potential of EVs but also underscores the transformative power they hold in shaping the future of mobility.”

Rami Kaushal, MD, Consulting & Valuation Services, India, Middle East & Africa, CBRE said, “The future of the EV industry is bright, and real estate will play a pivotal role in shaping its trajectory. As demand for EV manufacturing facilities, charging infrastructure, and associated services expands, the real estate sector will need to adapt and provide the necessary infrastructure and spaces to accommodate this growth.”