Experts believe that, in an increasingly complex global financial environment, staying compliant with regulations has become one of the most expensive and time-consuming challenges for organisations. As cross-border rules multiply and data grows exponentially, traditional compliance methods—often manual and fragmented—are falling behind.

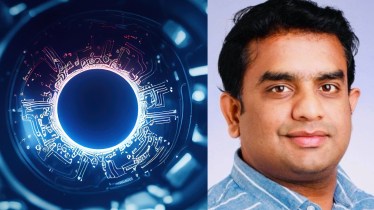

A recent study by AI researcher and automation engineer Balaji Adusupalli, published in Mathematical Statistician and Engineering Applications, takes a deeper look into how emerging technologies like artificial intelligence (AI) and blockchain can be used to build smarter, more adaptive systems for regulatory compliance.

Over the past decade, financial institutions have reportedly spent more than $2 trillion trying to keep up with shifting regulations like MiFID II, GDPR, and Basel III. Adusupalli argues that the traditional approach—rigid frameworks and human oversight—is no longer sustainable. His research makes the case for Regulatory Technology (RegTech) as a more flexible and scalable alternative.

“Most compliance systems react to risks after they happen,” Adusupalli notes. “We need systems that can identify and respond to risks as they emerge, and in some cases, even before they occur.”

AI: From reactive to predictive compliance

A large portion of the study focuses on how AI models—especially natural language processing (NLP) and predictive analytics—can handle compliance tasks faster and more accurately. For example, AI can be trained to:

- Classify financial transactions based on their risk profiles.

- Detect suspicious behavior in real time.

- Automatically generate reports tailored to new regulations.

- Forecast potential violations based on past data.

For students of data science or finance, this suggests a growing demand for interdisciplinary skills—where knowledge of machine learning could soon be as vital to compliance teams as legal expertise.

Blockchain: A new backbone for trust

While AI adds adaptability, blockchain brings transparency and integrity. Because of its decentralised and tamper-proof nature, blockchain can create permanent records of transactions, allowing regulators and auditors to trace compliance activities without relying on third-party validation.

The study points to how smart contracts could automate checks and conditions in financial agreements, while also ensuring compliance with Anti-Money Laundering (AML) and Know Your Customer (KYC) rules. These aren’t just theoretical ideas—many banks and fintech firms are already experimenting with or adopting these tools.

Case Studies: Where It’s already working

Adusupalli’s research features several real-world examples:

- UnionBank (Europe) adopted a blockchain-based compliance platform after facing regulatory penalties, and reduced its audit reporting workload by 78%.

- U.S.-based startups like AminoPath Insurance and CarbonPay Market used AI tools to simplify claims and policy management.

- In China, financial regulators have pushed for machine-readable reporting systems using the XBRL standard, which helps meet both local and international rules.

Looking ahead: Compliance-as-code

In a future where software runs everything from payments to contracts, Adusupalli envisions compliance being built directly into code—a concept he refers to as Compliance-as-Code. Here, rules aren’t just documents—they’re executable commands, making compliance automatic and real-time.

Rather than treating regulation as a checklist to be completed after the fact, this approach builds it into everyday operations—from the way data is stored to how transactions are approved.